Sign up to Newsletter Here

Want pdf report? Download it here

“Anyone who spends too much time thinking about international money goes mad.”

–Charles Kindleberger

Commentary & Analysis

Is Chinese yuan depreciation in the cards?

News on China from the Financial Times 6 April 2022:

China’s service sector suffered its worst contraction in March since February 2020 at the outset of the coronavirus pandemic, according to a closely watched private sector survey.

The significant contraction came as China battled its worst outbreak yet of coronavirus. with many cities, including the commercial centre Shanghai, undergoing strict lockdowns that have tested the limits of Beijing’s zero-Covid policy.

The Caixin services purchasing managers’ index, which asks companies in the sector whether they experienced an increase or decrease in business activity compared with the previous month. Came in at 42.0 on Wednesday, well below the 50-point threshold that separates contraction from expansion.

Chinese Shanghai Stock Index

Take Chinese President Xi Jinping’s crackdown on big tech. The blow-up real estate giant Evergreen, and mix that with China’s ongoing effort to transfer more wealth to households. It’s not difficult to see why there is increasing concern China may be unable to achieve its 5.5% annual economic growth target.

Given the factors above, it is no surprise the Institute of International Finance (IIF) showed $11.2 billion of outflows from Chinese government bonds. And $6.3 billion from mainland equities in its monthly flow tracker. It helps explain the significant underperformance of China’s stock market.

In the chart below comparing the US S&P 500 Stock Index to the Chinese Shanghai Stock Index. The relative outperformance is clear.

Despite the decline of money flowing to China, the IIF indicated other emerging markets attracted $8.3 billion over the same period. A Rhut Rho moment for Mr. Xi? Maybe, based on the reaction in China this week.

William Pesek, from the Asia Times. A longtime observer of Asia finance based in Tokyo, said China’s recent announcement of a “stability fund” could be a “game changer.”

TOKYO (7 April 22) – As President Xi Jinping tries to bring order to Asia’s biggest economy, he’s expanding the central bank’s mandate in ways that may prove game-changing. On Wednesday, the People’s Bank of China (PBOC) unveiled details of a new “stability fund” to steady wobbly financial firms.

“In the face of complex economic and financial situations at both home and abroad, it is necessary to proactively set up an authoritative and efficient system to prevent, resolve financial risks, and prepare for rainy days,” the PBOC said in a statement.

More juice to the economy? For sure…

Writes Pesek, “Though details remain vague, the strategy is to set up a comprehensive cross-regulatory-agency mechanism to detect risks in too-big-to-fail entities in China’s $60 trillion financial system and dispose of bad assets.

“The size of the fund is yet-to-be-determined, though local media suggest it will start out in the ‘several hundred billion yuan’ range. The fund will be financed by Chinese financial institutions and regulatory agencies.

“Most importantly, the new fund would be the Xi era’s first real crack at a broad guardrail for the entire system – not only scattered and targeted sectors. Significantly, this enterprise involves seven government agencies. Including the central bank, the Ministry of Finance and Beijing’s banking, securities and foreign-exchange regulators.

“The stability fund wouldn’t only dwarf other mechanisms to rescue troubled institutions and their depositors. It would have broad discretion to police China Inc from the very top.”

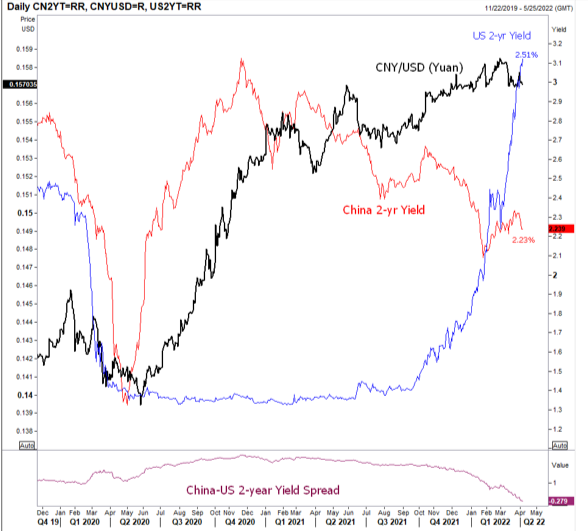

The chart below compares the benchmark 2-year Chinese interest rate (red); to the 2-year United States interest rate (blue); to the Chinese currency priced in US dollars (black). The bottom pain represents the spread between China and US 2-year interest rates (purple).

Takeaway:

- The 2-year yield spread between China and the United States is now favoring the US dollardespite the big rally in the Yuan.

- The Fed is expected to hike the Fed Funds rate further this year, possibly aggressively. While the Chinese 2-year yield may actually fall given the new package announced by Mr. Xi in attempts to stimulate growth.

- Thus, we raw material for an increase in the supply of yuan relative to US dollars with hot money flow (defined as short-term capital sloshing across the globe in search of yield and capital gain). Favoring the buck which is usually a powerful short-term driver of currencies.

Time to buy USD/CNY?

If you like what you see here, you can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Team…

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.