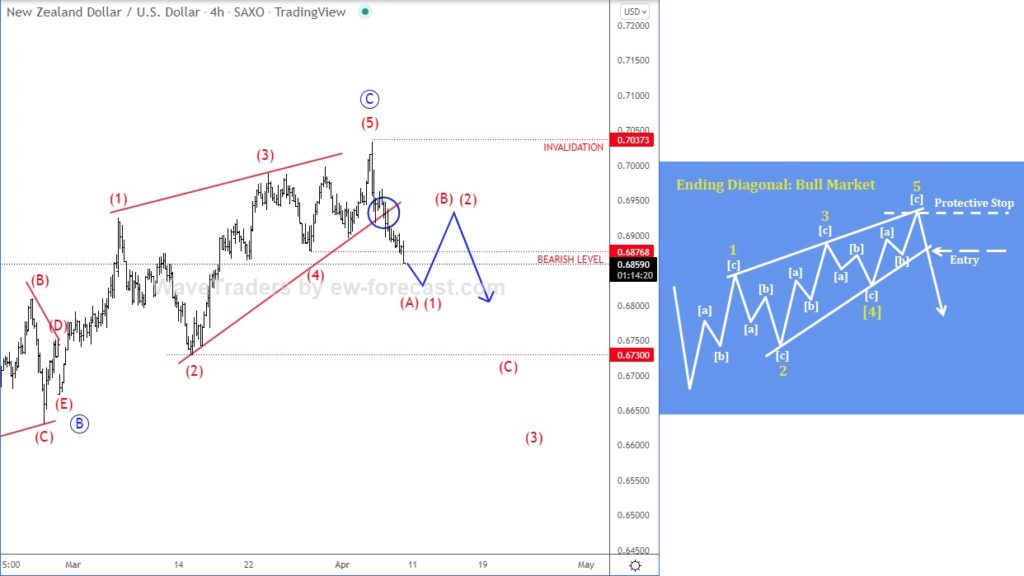

Hello traders! Today we will talk about the Kiwi (NZDUSD) pair in which we see pretty nice and clean elliott wave pattern. Called ending diagonal a.k.a. wedge pattern.

As you can see, recent recovery from January lows was slow and ovarlapped which indicates for an elliott wave A-B-C corrective movement. Specially if we consider elliott wave ending diagonal (wedge) pattern within wave C.

The ending diagonal is a special type of wave that occurs in wave 5 of an impulse, or wave C of a correction. This wave often occurs when the preceding move of the trend has gone too far, too fast, and has run out of steam. An ending diagonal pattern is a type of pattern that can occur at the completion of a strong move. It reflects a “calming” of the market sentiment such that price still moves generally in the direction of the larger move. But not strongly enough to produce an impulsive wave. Ending diagonals consist of five waves, labeled 1-2-3-4-5. Where each wave subdivides into three legs. Waves 1 and 4 overlaps in price. While wave 3 can not be the shortest amongst waves 1, 3, and 5.

The reason why they are so interesting is that they are indicating a reversal, usually a strong one. That said, after a completed ending diagonal. Prices are expected to go back to the level, where the pattern had started.

Well, if we respect the rules. Then current sharp decline from the highs and out of wedge pattern can be indicating a reversal down at least in three waves (A)/(1)-(B)/(2)-(C)/(3). That can send the price at least back to the starting point of ending diagonal formation at 0.6730 level for wave (C). However, in case if this level is broken decisively. Then we can also consider wave (3) of a bearish five-wave impulse.

Trade well!