We talked about silver already back on August 09, where we mentioned and highlighted a higher degree correction within uptrend. Since then, we got a nice impulsive five-wave rally. CLICK HERE

Every day we are tracking and updating intraday charts for our members and we want to share an interesting flashback educational article on how we spotted a bullish setup formation. Well, the main thing why we are bullish on silver is definitely nice and clean five-wave impulse in August that was followed by a deeper corrective setback at the beginning of September.

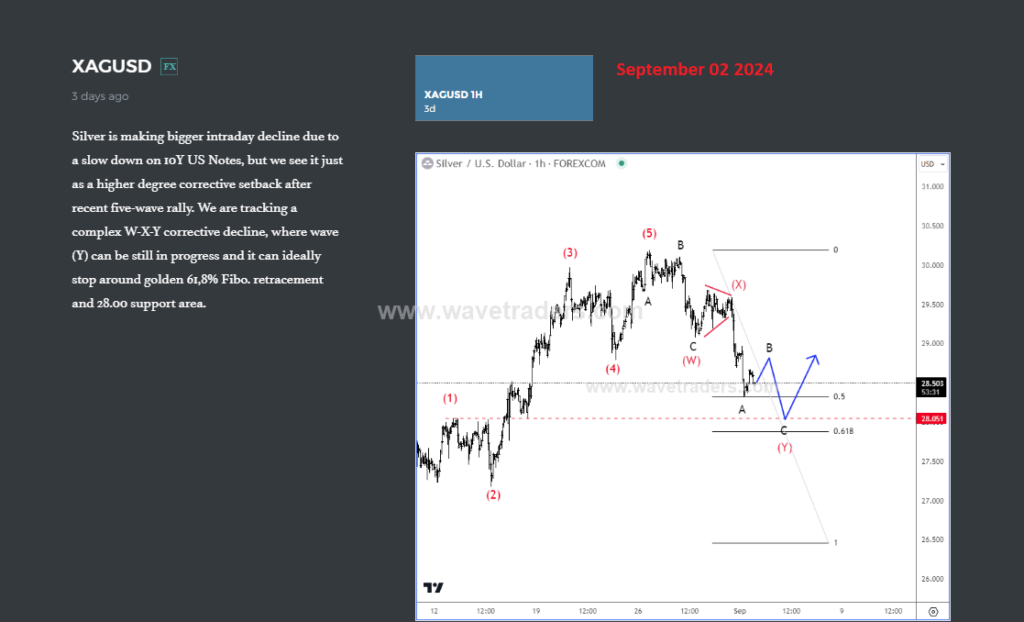

On Monday September 02 2024, we have been warning our members about a complex W-X-Y corrective setback that can touch the golden 61,8% Fibo. retracement and 28.00 support area, from where we would expect a continuation higher.

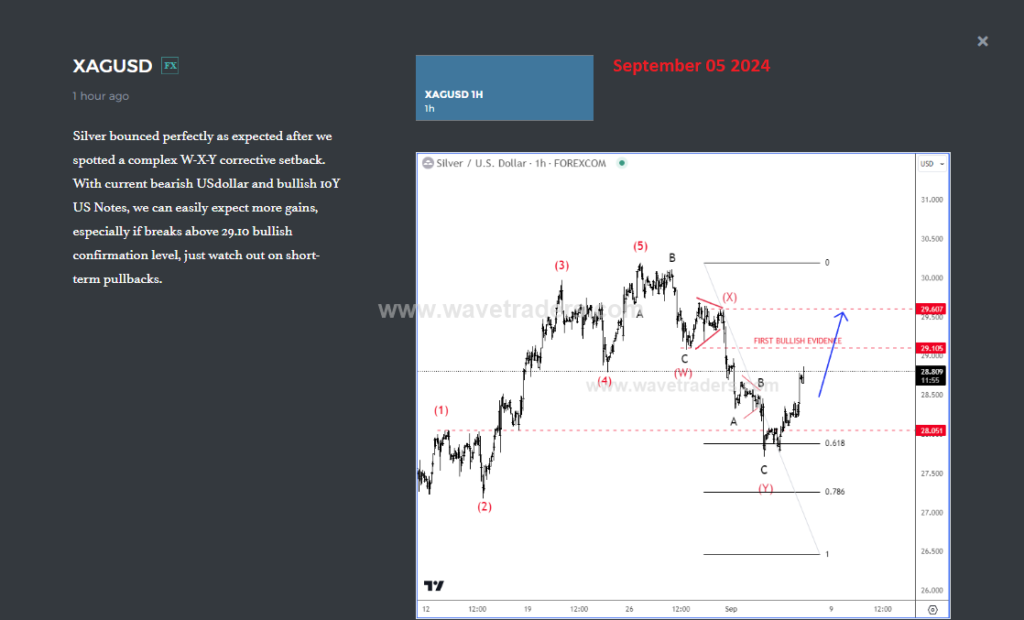

As you can see today on September 05, silver bounced perfectly as expected after we spotted a complex W-X-Y corrective setback. With current bearish USdollar and bullish 10Y US Notes, we can easily expect more gains, especially if breaks above 29.10 bullish confirmation level, just watch out on short- term pullbacks.

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.