JP Morgan Is Eyeing 200 Area, as we see bank sector back to bullish mode from Elliott wave perspective.

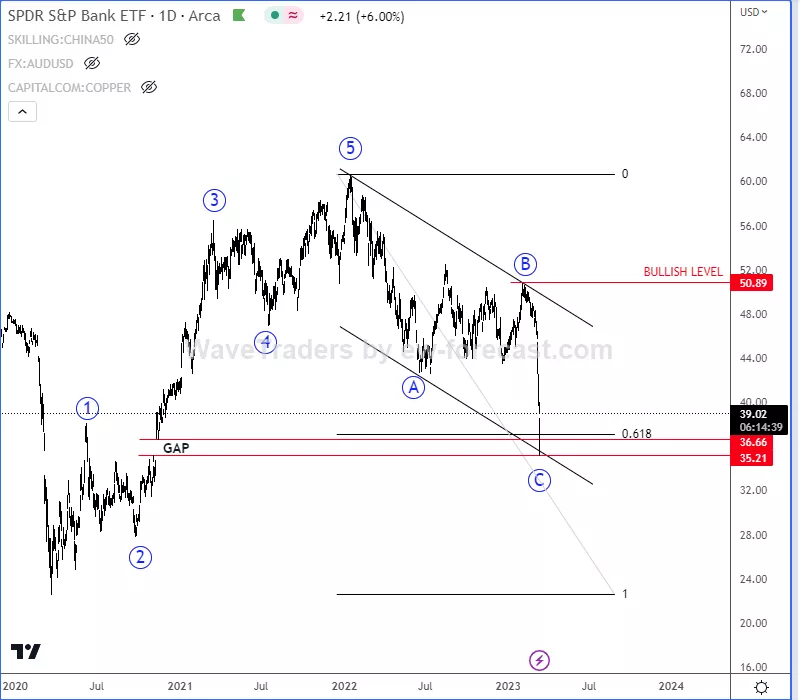

We already talked about the Bank sector in the last year. Back in March of 2023, when everyone was in fear due to bank collapses, we warned about that markets go from pessimism (fear) to optimism (greed) and vice versa. We also shared a chart with ticker KBE, where we were tracking an A-B-C corrective decline within uptrend.

As you can see today, the BANK sector with ticker KBE is currently one of the strongest with room for more gains. As expected actually, KBE – Bank Sector ETF is nicely breaking above channel resistance line that can send the price higher in 2024, especially if breaks 50 bullish confirmation level, just watch out on short-term pullbacks.

At the same JP Morgan with ticker JPM is just about to break all-time highs, ideally out of a larger weekly bullish running wave (4) triangle pattern for a higher degree wave (5), which can push the price up to 200 area. Of course, be aware of short-term pullbacks.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Natural Gas May Face A Recovery In 2024. Check our free chart HERE.