In the upcoming week, the financial markets are poised for a series of crucial events, with a particular focus on the U.S. economic landscape. A key highlight will be the U.S. inflation report, which is anticipated to slightly decrease from 3.2% to 3.1% year-over-year. This data will be essential in gauging the current inflationary trends and their potential impact on future monetary policy.

Additionally, the Federal Reserve’s rate decision on Wednesday will be a pivotal moment for the markets. The Fed’s decision, especially in the context of recent robust US jobs data, could influence market sentiment and the direction of the dollar. The implications of this decision will not be isolated to the US. but will have global repercussions, as it coincides with rate decisions from other major central banks, including the SNB, BoE, and the ECB.

The market’s reaction to these events could be complex and multifaceted. While the US jobs data has shown strength with rate coming down to 3.7%, the inconsistency between jobs data and inflation figures could lead to a period of uncertainty and choppiness, particularly in dollar-denominated currency pairs.

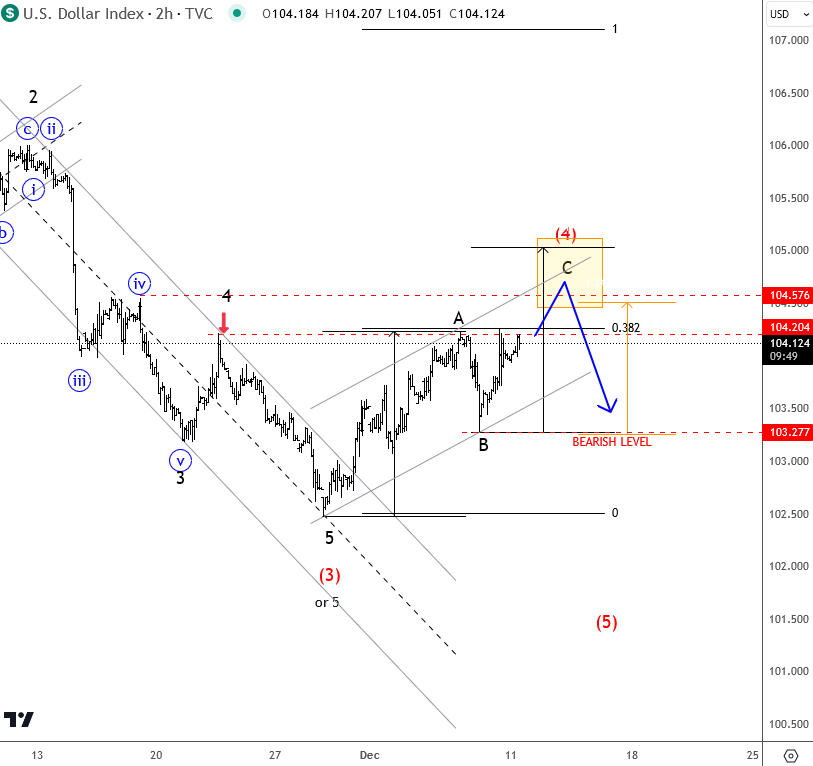

From an Elliott Wave perspective, the U.S. Dollar Index (DXY) appears to be in a corrective a-b-c rally, currently within a wave four. This suggests a potential move towards the 104.50-105 resistance zone from where I will expect a resumption lower, but a catalyst might be required for this downtrend to continue. The upcoming economic events could serve as such a catalyst, potentially influencing the DXY’s trajectory and offering insights into the broader market trends.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

NZDUSD Is Recovering In An Impulsive Fashion, as it’s one of the strongest currencies for the last couple of weeks. READ MORE HERE