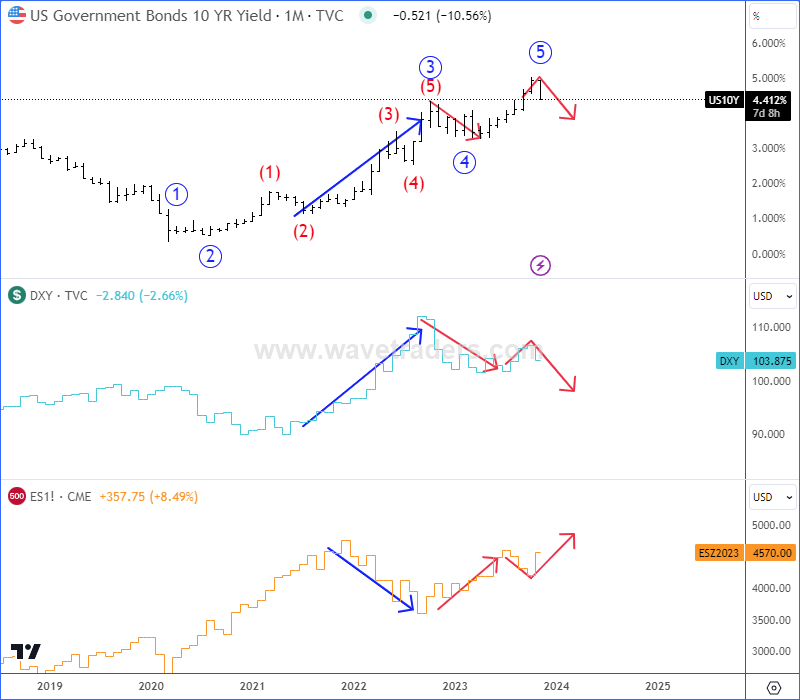

On August 31 we shared an article about Major Market Correlations Between Yields, Stocks And USDollar. We warned about a potential change in the trend, as US yields and DXY were moving into resistance, while stocks into support. CLICK HERE

As you can see today, correlations are playing out nicely and looks like the trend is changing now. US Yields are turning down after a completed wave 5 that caused a reversal down on DXY from resistance, which is supportive for stocks. This trend may now last at least to the first half of 2024.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Bitcoin Ready To Break Higher On Thanksgiving Day. Check our blog HERE.