Free Charts

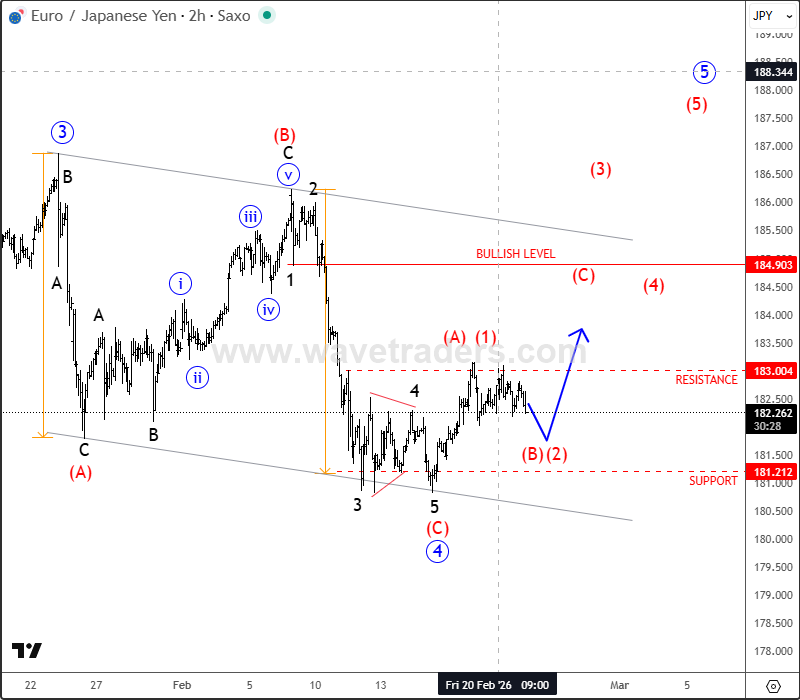

EURJPY appears to be forming a bullish wave structure after completing a higher-degree Wave 4 correction. A continued recovery toward the 183–184 area is possible once the current pullback completes.

SHIBUSD is testing major 2021 support and may be completing a wedge pattern within a larger ABC correction, which could lead to a rebound. However, true bullish confirmation requires a break above the former wave (4) swing high.

Silver has dropped over 40% from its highs after a massive 300% rally, and the decline still appears impulsive on the 4H chart. While support sits near 70, the 65–92 range suggests a possible B wave, meaning upside could be limited. Key resistance levels are 80–83 and 90–100.

GBP/USD hit 1.3870 above the 2025 highs but reversed impulsively, signaling possible short-term weakness. A break below channel support would strengthen the bearish case, with resistance at 1.3700–1.3750.

Crude oil remains in a short-term corrective pullback within a broader bearish wave structure. Price action suggests one more decline toward the $60 support zone before a potential larger recovery phase begins.

Elliott Wave Free Charts - Wavetraders

On this Elliott Wave analysis page we share some selective Elliott wave free charts and quick market updates and Elliott wave videos that might be important based on particular global market events that are happening right now. All our Elliott wave charts published on this page can be interesting for…

On this Elliott Wave analysis page we share some selective Elliott wave free charts and quick market updates and Elliott wave videos that might be important based on particular global market events that are happening right now.

All our Elliott wave charts published on this page can be interesting for our clients, for their trading or investment ideas based on the quality of the Elliott wave pattern. We also want to deliver some of our Elliott wave material and analysis free to our readers because we want to help others to understand the psychology and dynamics behind the market trends.

If you want some of our Elliott wave charts to be delivered straight to your email box then please sign up to our Elliott wave newsletter HERE. Like what you see here, but want more of such updates daily? Then take it to the next level and sign up to our Elliott wave premium analysis now and check what our Elliott wave analyst have to say about different markets now.