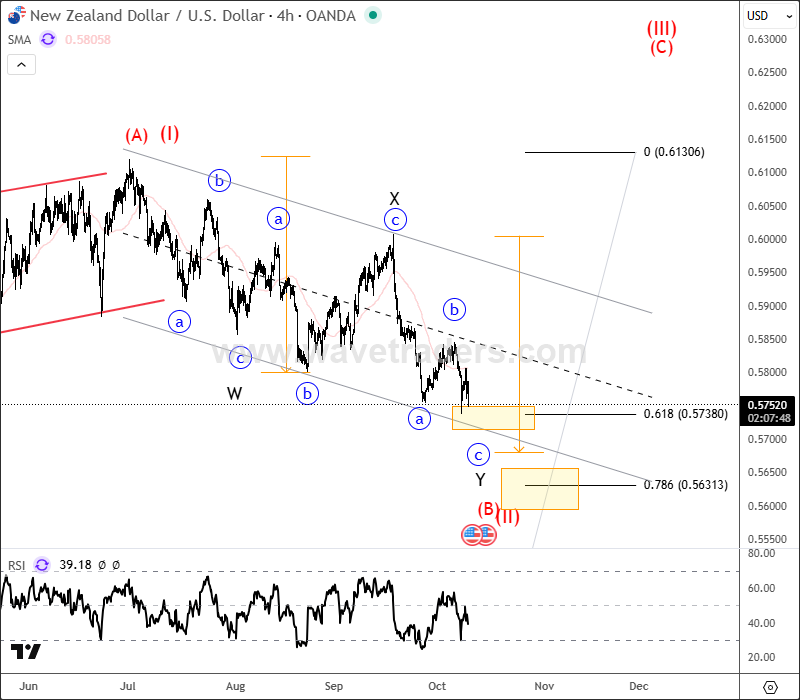

NZDUSD(Kiwi) came lower, fell quite aggressively back in September from the 0.60 psychological after the Fed decided to cut rates by 25 basis points, but Powell also sounded concerned about inflation and the economy, so USD came higher. Looking at the wave structure, it seems price is now trading in subwave “c” of Y of a complex W-X-Y corrective decline from the July highs, meaning this is a correction that can come to an end at around the channel support near 0.5700 level. So we expect that sooner or later kiwi will stabilize, but until we recover above the corrective channel the bullish trend is unconfirmed, but we think it can show up while the price is above 0.5488 level.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.