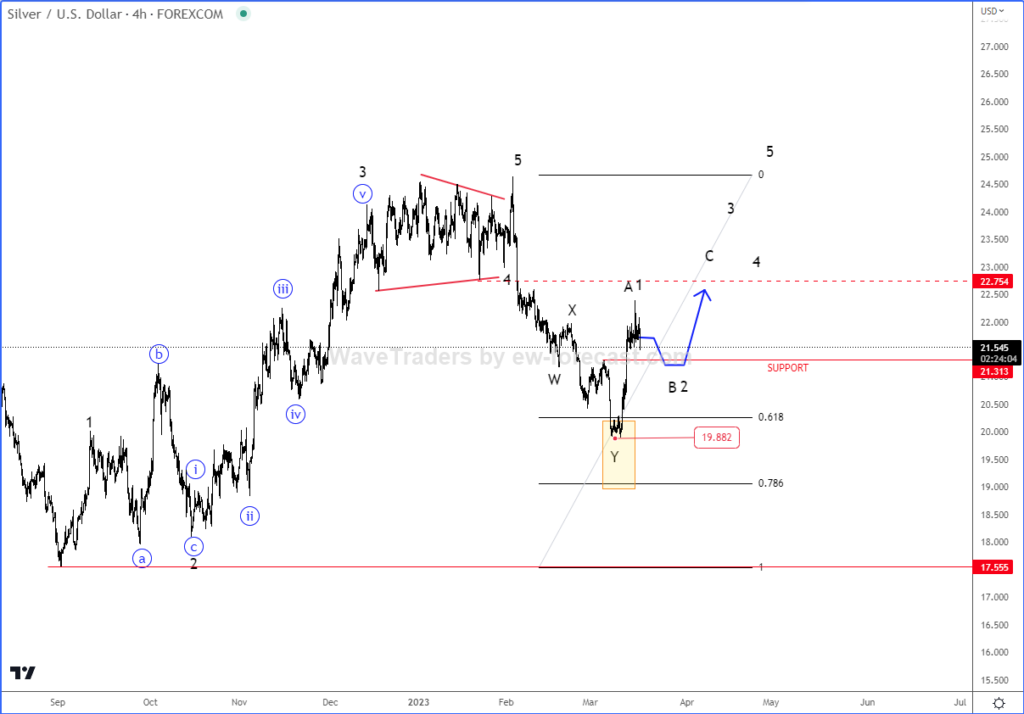

Silver with ticker XAGUSD made strong and impulsive rally since September 2022 till February 2023. A sharp drop in February from 24.50 and break below 22.50 supports suggests that metal is in a higher degree correction. That’s quite strong decline, but due to a five-wave rally earlier, we still see it as part of a complex sharp W-X-Y correction with the support here in the 61,8% – 78,6% Fibonacci retracement and 20-19 area.

We can currently see a nice bounce from the support, but due to sharp leg down previously, we are tracking a minimum three-wave A/1-B/2-C/3 recovery at least up to 22.75 area for wave C or maybe even higher and back to highs for wave 3 of a new five-wave bullish impulse.

Support on intraday dips is at 21.30 followed by 20.60

Check our latest video analysis sponsored by Orbex HERE