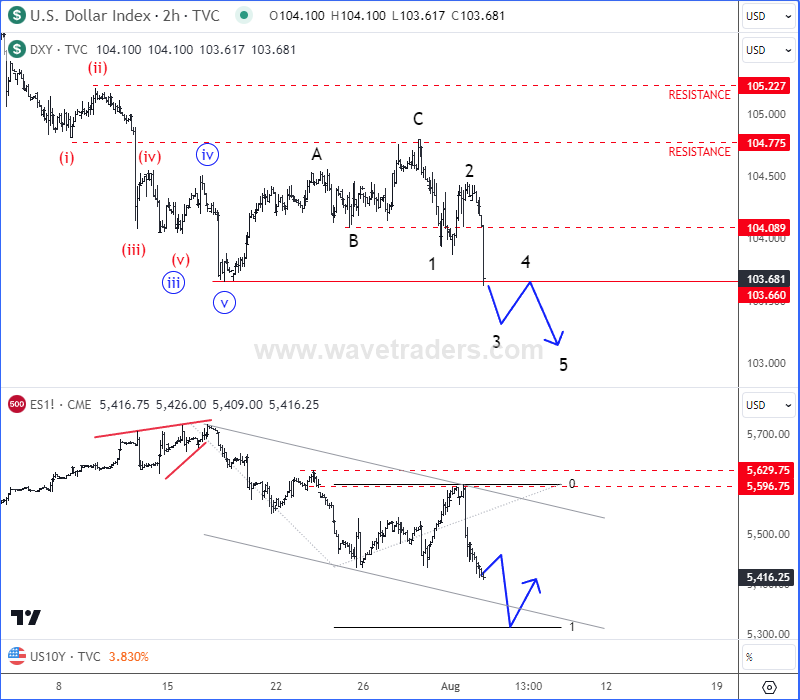

US jobs data (NFP) disappointed where it comes out 114K vs 176K expected, while unemployment rate changed from 4.1% to 4.3%. We can see USDollar Index – DXY coming lower, breaking new intraday lows, but along with stocks, as we are still in risk-off sentiment. At the same time, JPY and metals remain as safe haven assets, because 10Y US Notes is now extending strongly higher with space for more gains. We believe that DXY might stay under bearish pressure within a new five-wave bearish impulse, especially if we will get stabilization in the SP500 after it fully completes a corrective decline.

If you want to understand the markets and to follow them step by step, then you may want to become a member of www.wavetraders.com

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.