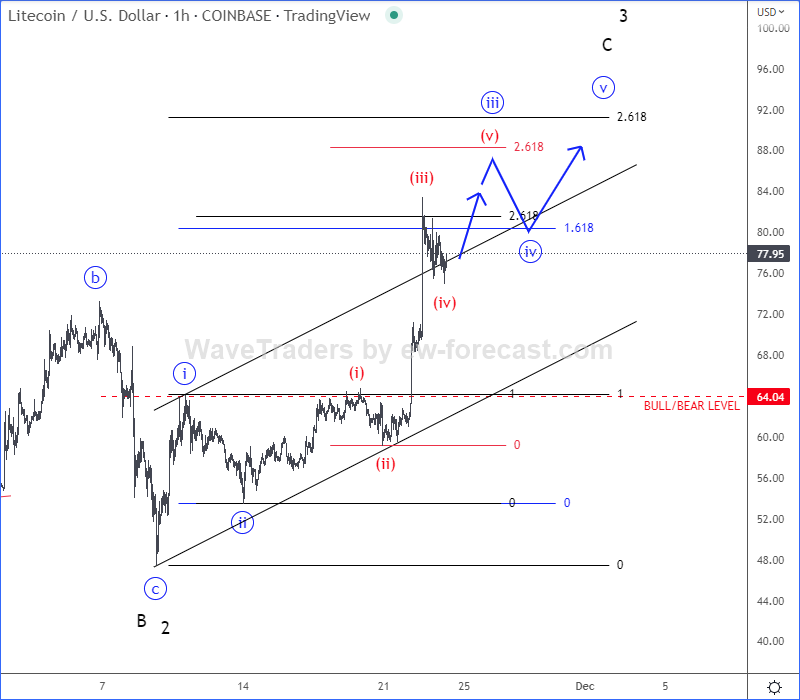

LiteCoin is looking higher, as we see an unfinished five-wave cycle of the lower degree from Elliott wave perspective.

Litecoin made some nice breakout above November highs recently, which we see it as a higher degree wave C or maybe even wave 3 after a completed irregular/expanded flat correction in B/2 on November 9th.

LTCUSD hasn’t finished its rally yet, it’s still pointing higher within wave C/3, as five-wave cycle of the lower degree looks to be unfinished. So, be aware of further rise at least up to 90 area for wave C, if not even above 100 for wave 3.

Don’t forget, risk-on sentiment seems to be back in the game, as stocks are recovering and USD is losing its power that can be easily in favor of Crypto.

A catalyst for even further weakness of the buck in the last two sessions are FOMC minutes in which members noted that they will be careful with hiking rates going forward. This sounded dovish so US yields came down, notes higher which had a negative impact on the USD and a positive on stocks. So lower USD can definitely help cryptos, especially those that are doing well for the last few days, such as LTC.

All the best!

Check our latest video analysis sponsored by Orbex. CLICK HERE