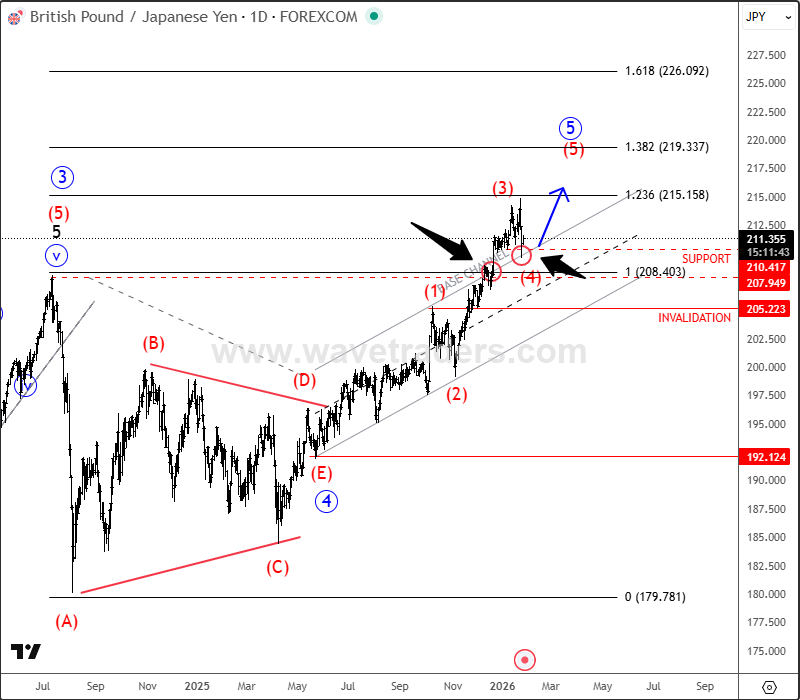

GBPJPY is breaking out of its base channel after pushing above the 208 level, which also acted as a major resistance throughout 2024. Since the breakout, price action shows a strong recovery, suggesting an impulsive move originating from the 192 area. The market is currently undergoing a corrective pullback in wave (4), testing the projected 210 support zone. As long as this support holds, a bullish continuation into wave (5) is favored, with upside targets in the 215–220 area. The bullish outlook is invalidated below 205. As long as price remains above this level, the broader trend stays bullish.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.