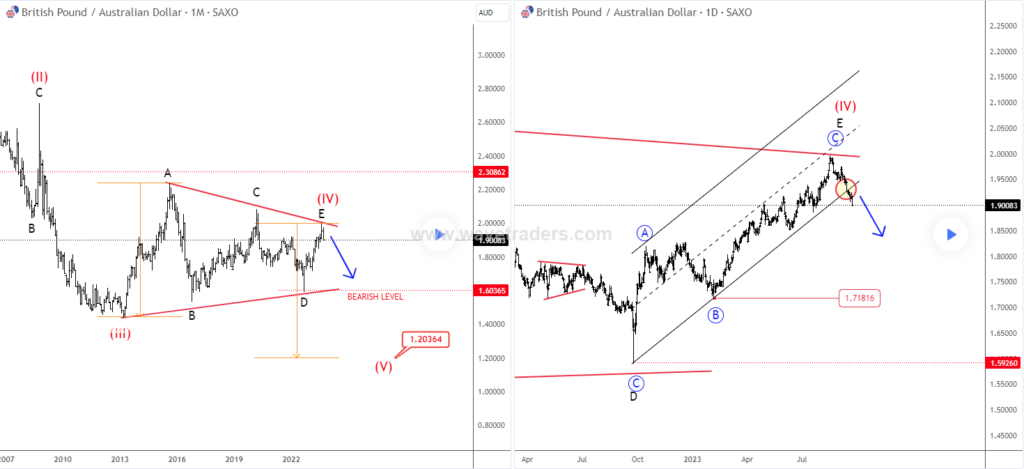

GBPAUD Is Finishing Multi-Year Bearish Triangle from technical point of view and from Elliott wave perspective.

GBPAUD is unfolding a five-wave bearish cycle on a monthly basis, currently finishing a bearish triangle pattern within wave (IV). Big turn down can occur.

It turned bullish at the end of 2022 and start of 2023 after completion of a three-wave A-B-C decline for a higher degree wave D down at 1.59 area, from where we have seen a strong rebound but once again can be a three-wave A-B-C recovery for wave E. However, subwave C appears to have an extended structure, with nice resistance at 2.00 area. There is still a chance for a reversal down, especially now that is breaking channel support line, but we want to see a weekly close below the channel to confirm that bears are back.

SP500 Update: It’s Coming Lower With A Zig-Zag Correction. Check our blog chart HERE.