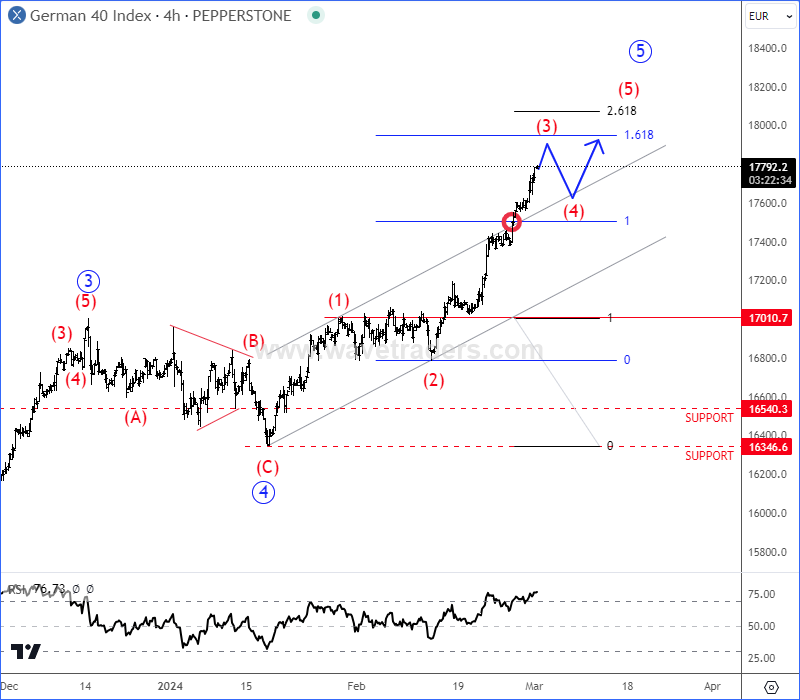

DAX remains in bullish trend, and it’s very strong one; a move that can resume even higher. The short-term, 4h time frame shows that market is in a fifth wave up from 16346 low, but it seems there is room for more gains within a projected five-wave bullish cycle of the lower degree. Currently we are tracking wave (3) with room up to 17800 – 17900 area, just be aware of wave (4) pullback before a bullish continuation for wave (5) of 5 towards 18k.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Japanese Yen May Face A Recovery. Check our blog HERE.