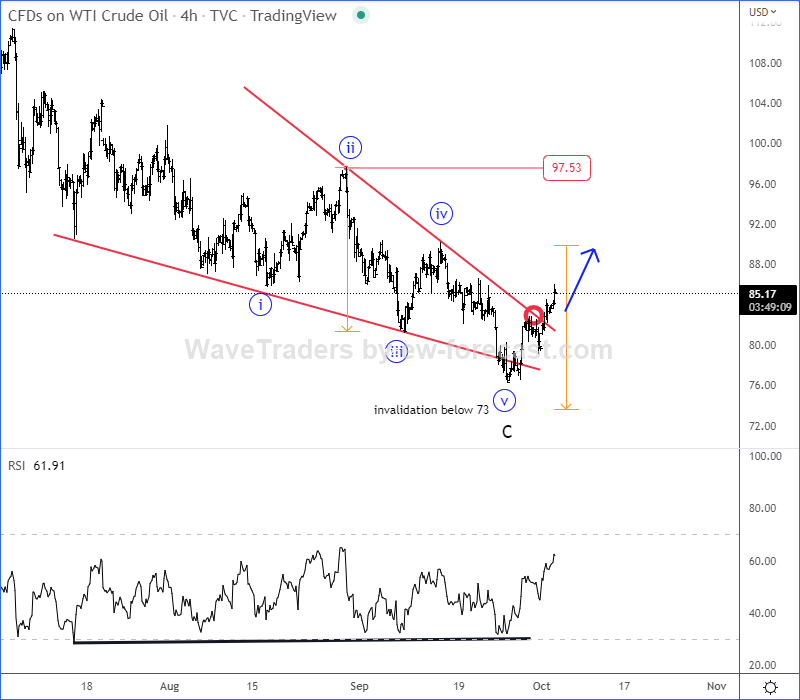

Crude oil can be turning bullish, as we see it breaking out of the wedge pattern from Elliott wave perspective.

Crude oil has been trading south for the last couple of months, but the price action is not so strongly bearish anymore and the wave structure is getting overlapped. It means that Crude oil is running out of steam within an ending diagonal (wedge) shape.

Well, with current break out of that wedge pattern and with recovery above the upper ending diagonal line, seems like Crude oil found the support. However, from technical point of view keep in mind that bulls can be confirmed only above 97.50 region.

One of the main reasons why Crude oil can be supportive is bearish USDMXN as they are in negative correlation. Looking at the USDMXN daily chart we can see it clearly bearish, currently finishing a big bearish triangle formation within wave B. So, it can send the price even lower within wave C towards February 2020 pandemic lows.

Respecting the price action from technical point of view and wave structure from Elliott wave perspective, seems like USDMXN will face more weakness, while Crude oil may start recovering in an impulsive fashion.

Happy trading!

Interested in gold? Check our latest article HERE