Free Charts

USDCHF remains under bearish pressure despite higher inflation, suggesting wave "d" may be in progress. A brief recovery for wave "e" is still possible to complete a wave 4 abcde triangle, before a potential bearish breakout into wave 5.

Market structure suggests a potential shift in dominance that could favor altcoins, but confirmation still depends on broader crypto market strength.

AUDJPY is advancing in Wave 5 after a bullish Wave 4 triangle. Above 108.82, price can extend toward the 113 target area, with minor pullbacks possible.

The DAX is consolidating above 24,100 within a wave B correction, with a triangle or irregular flat possible. As long as support holds, a wave C recovery and further upside remain likely.

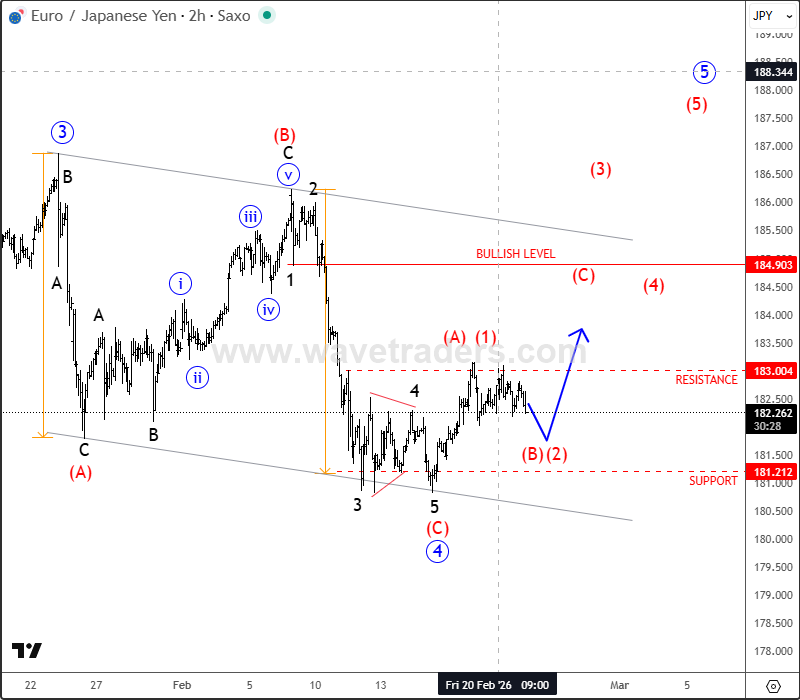

EURJPY appears to be forming a bullish wave structure after completing a higher-degree Wave 4 correction. A continued recovery toward the 183–184 area is possible once the current pullback completes.

Elliott Wave Free Charts - Wavetraders

On this Elliott Wave analysis page we share some selective Elliott wave free charts and quick market updates and Elliott wave videos that might be important based on particular global market events that are happening right now. All our Elliott wave charts published on this page can be interesting for…

On this Elliott Wave analysis page we share some selective Elliott wave free charts and quick market updates and Elliott wave videos that might be important based on particular global market events that are happening right now.

All our Elliott wave charts published on this page can be interesting for our clients, for their trading or investment ideas based on the quality of the Elliott wave pattern. We also want to deliver some of our Elliott wave material and analysis free to our readers because we want to help others to understand the psychology and dynamics behind the market trends.

If you want some of our Elliott wave charts to be delivered straight to your email box then please sign up to our Elliott wave newsletter HERE. Like what you see here, but want more of such updates daily? Then take it to the next level and sign up to our Elliott wave premium analysis now and check what our Elliott wave analyst have to say about different markets now.