USDJPY has been in recovery mode for some time, forming higher swing lows and retesting the highs following a rebound in US yields, as Powell didn’t fully convince markets about a December rate cut. The BOJ has also kept rates unchanged, so until they turn more hawkish, the pair could stay supported — unless a broader dollar selloff begins due to risk-on, which would help drive USDJPY lower across the board whiel US yields could stay sideways till next FED meeting.

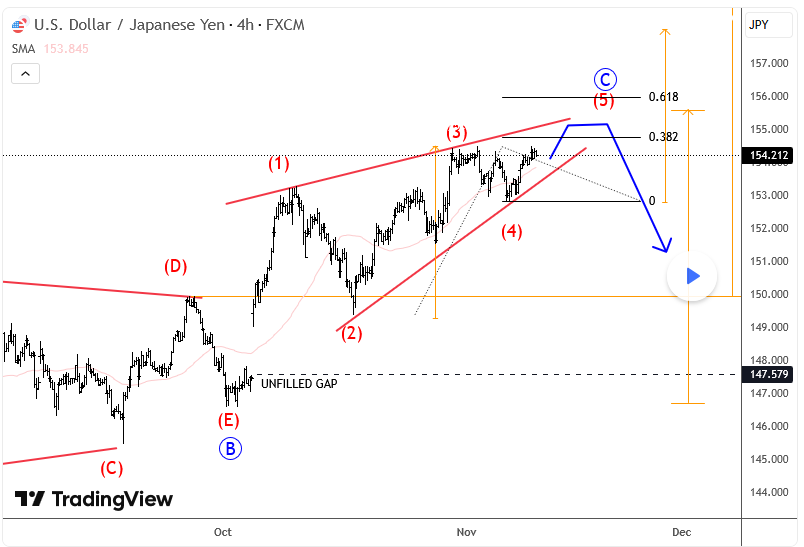

Looking at the wave structure from early October, price action over the last few weeks has become increasingly overlapping, which often signals an ending diagonal ; a powerful reversal pattern where bullish momentum starts to fade. This suggests that we may be approaching a very important bearish turn in the coming weeks. I’m watching the 155–156 region as key resistance; if the market fails to break and hold above the upper boundary of the diagonal and instead breaks below the lower trendline later on, that would confirm a potential bearish reversal.

I’m also keeping an eye on the large gap from early October; gaps of that size rarely stay open for long in the spot market, so a move back to fill it remains a realistic scenario, but dont know when…

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.