Good morning, traders! The US Dollar continues to weaken aggressively, while equities are pushing higher as anticipated, confirming that a risk-on environment remains in play. As long as the USD has room for further downside, stocks may continue to trade within a bullish trend. However, caution is warranted ahead of today’s FOMC meeting, as increased volatility and potential pullbacks are likely.

If the Fed does not deliver a rate cut as expected, markets could react with a short-term risk-off move. That said, the sharp decline in the USD may suggest that a rate cut is already partially priced in. A surprise cut would likely extend USD weakness further and support equities and risk assets.

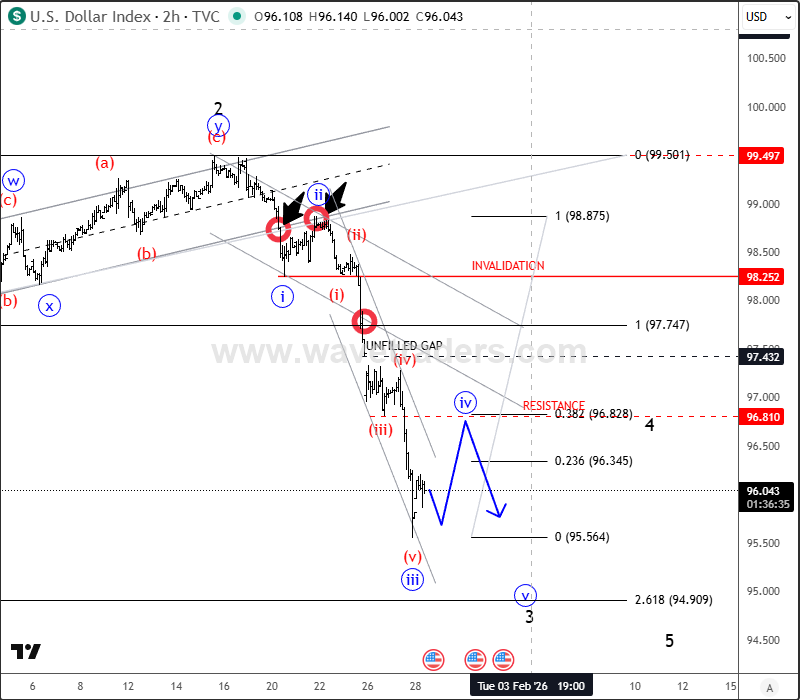

From a technical perspective, the US Dollar Index (DXY) remains under intraday bearish pressure with scope for additional downside. Still, the structure suggests that price may be completing subwave (v) of wave iii. This opens the door for a corrective rebound in wave iv, potentially revisiting the 96.40–96.80 resistance zone. If that correction unfolds, it could be followed by another impulsive sell-off in wave v of wave 3, targeting the 94.00 area.

Key takeaway: trend remains bearish for the USD, bullish for risk—but the Fed decision is the near-term catalyst that could reshape the next move.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.