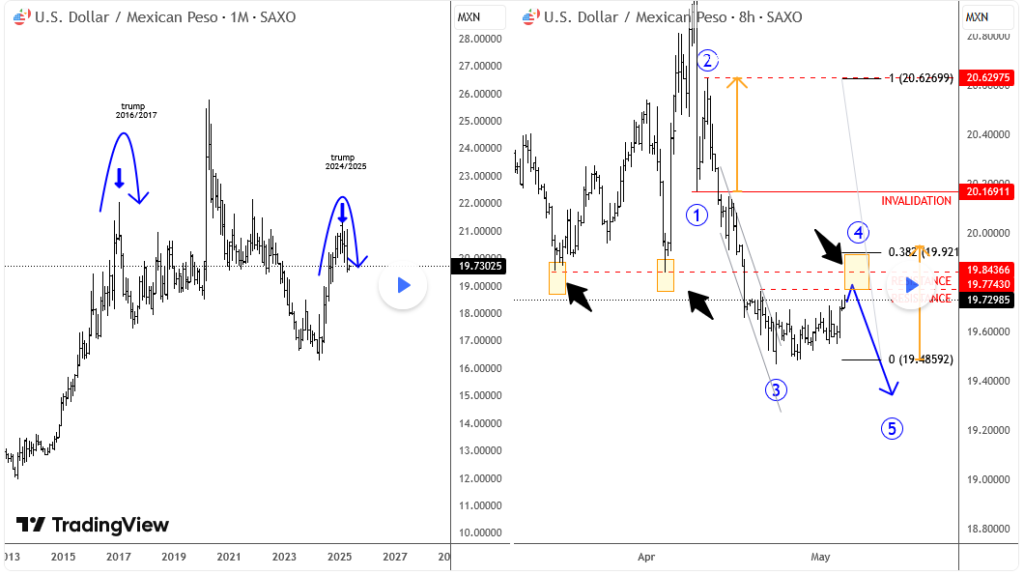

Back in 2016–2017, we first saw a very sharp recovery on USD/MXN, but when Trump took office in January 2017, the market reversed strongly lower, falling all the way from 22 to 17.60, lost nearly 20% . That very similar pattern is now becoming visible again with 2024–2025 price action. Last year, after Trump won the US election, we saw significant depreciation of the Mexican peso, but since he has officially taken office in January, we’re seeing a complete reversal—just like in 2017.

In fact, the Mexican peso has been gaining nicely over the past few months, likely based on speculation that Trump will find the agreement and trade deals with other countries, particularly related to tariffs. Since no one really benefits from trade wars, it’s not surprising that even Trump’s recent remarks reflect an acknowledgment of the global situation being unsustainable, especially when it comes to CHINA-US trade.

With that in mind, markets in general are likely to recover, and we’re already seeing some nice rebounds. And when stocks are in recovery mode, commodity currencies—including the peso—tend to perform well.

Looking at USD/MXN specifically, we’re seeing a strong reversal down from February highs, just like in 2017. The current drop hasn’t even retraced 38.2% of the 2024 rally yet, which suggests more downside is likely—ideally toward the 19.00 area, maybe even 18.00 by year-end.

From an Elliott Wave perspective, it’s useful to zoom in on smaller time frames. The structure doesn’t look like completed impulse yet, so technically there can be more weakness coming. Resistance for wave four rally sits around the 19.77–19.84 zone, which aligns with Fibonacci projections for wave four, as well as swing lows from March and April.

This area could serve as a nice resistance of the current bounce, especially if the Fed delivers any dovish remarks this week. No rate cuts are expected, but even a hint at future cuts could send the US yields lower, which would weigh on the dollar and support risk assets—meaning commodity currencies could outperform.

In that case, USD/MXN could ideally fall back below 19.50.

Elliott Wave analysis also helps define clear invalidation levels, very important when it comes to potential trade setups. In this scenario, 20.16 is a key level to watch. A break above it would overlap with the start of the current move and signal that the bears are finished for now, thus I would need to adjust the view accordingly.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.