Stocks closed positive on Friday with SP500 and NASDAQ100 erasing some of the losses from the first half of last week. We also saw a nice rebound on European markets as inflation comes down to 5.5%, more than expected, but it’s still somehow high with core inflation at 5.4%. USD came down at the end of the week, which can be a surprise for some speculators from a macro perspective if we consider that Powell highlighted a hawkish view in his recent speech. So key will be more data releases this week, with ISM Manufacturing PMI today, FOMC Meeting Minutes on Wednesday, and maybe the most important will then be US NFP on Friday. Also, traders will keep an eye on RBA rate decision which will be released on Tuesday during the Asian session. Expectations are on hold, at 4.10% which certainly can be the case if we consider that inflation in Australia came down much more than expected, to 5.6% from 6.8% y/y.

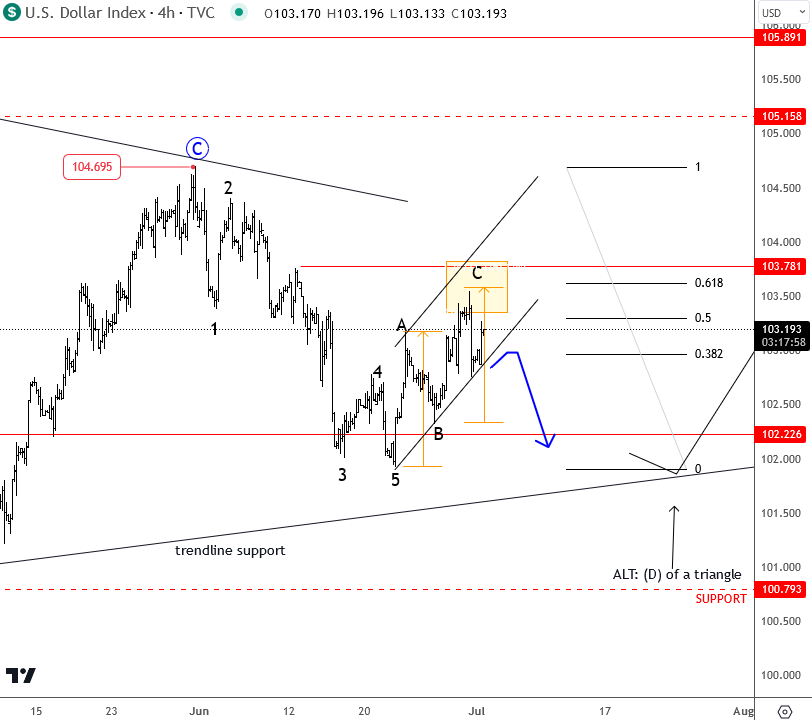

Now, looking at USD from an Elliott wave perspective, there was a clear three-wave recovery from June lows; it’s an A-B-C move, thus a correction that suggests more dollar weakness going forward, possibly already straight from here. But even if higher resistance is going to be retested, I still think that sooner or later downtrend toward 101.90 will show up. So, other major currencies may find some buyers, but maybe this won’t be the case for very weak JPY, unless BoJ will be more aggressive, trying to defend the JPY’s weakness. However, for any real flows and breakouts, we maybe have to wait till the second half of the week as today’s and tomorrow’s markets can be slow due to US independence day. US markets will close early today and will be closed tomorrow.

If you like to follow our updates regularly, then check our premium section.

Grega