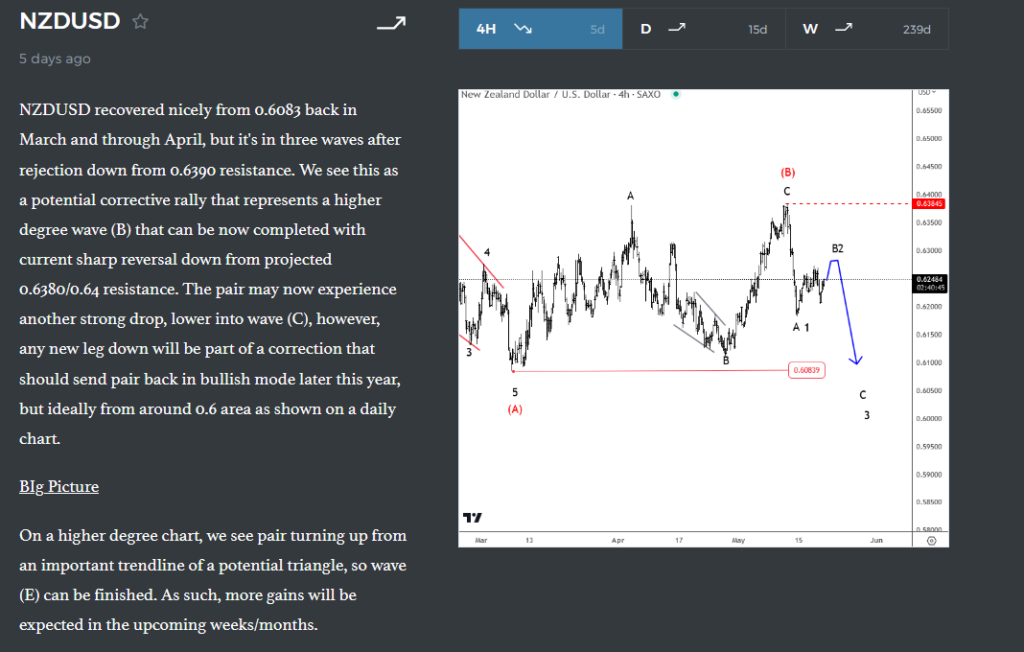

The Kiwi resumed lower into wave (C) after we spotted a corrective rally in wave (B) by Elliott wave theory.

The Kiwi a.k.a. NZDUSD was consolidating since March, which we saw it as an A-B-C corrective rally in wave (B). On May 19th, we warned about further weakness within wave (C), when wave (B) correction was confirmed by sharp decline.

As you can see today, Kiwi is already falling, which is not a surprise based on Elliott wave terms about we also discussed in our webinar. Technically this move was expected and even supported from a macro perspective as we were looking for speculators to sell into RBNZ as there was “no surprise” on the schedule. Yes, they hiked, but its always important to look at what to expect in upcoming meetings. The market expects that RBNZ is approaching the end of the cycle, so NZD is coming down big this time. We see the pair falling into a third leg of an impulsive sell-off so more weakness can be expected for wave 5 of (C) towards 0.60 – 0.59 area after any short-term rally up into subwave 4.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Want to see more analysis like this? Check our latest video analysis sponsored by Orbex HERE.