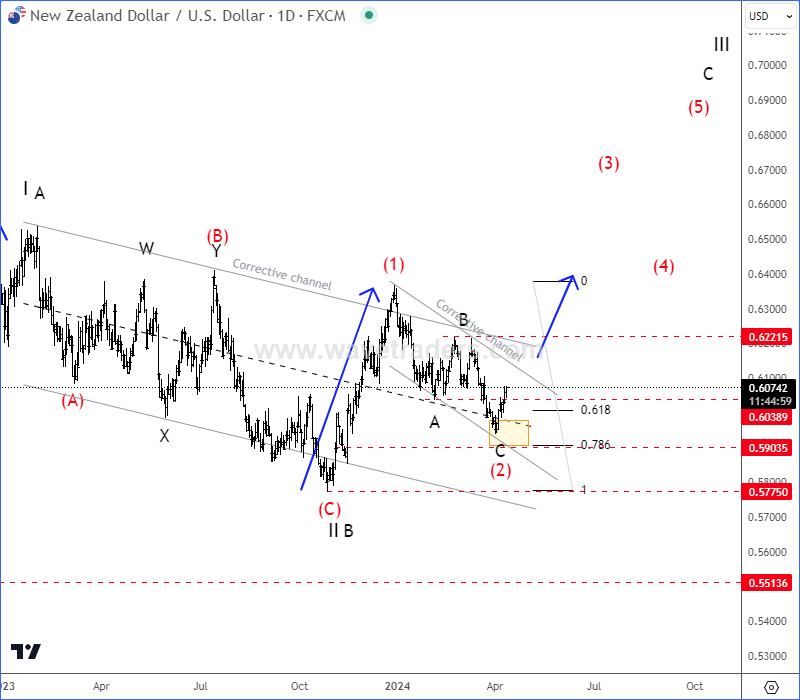

The Kiwi Is Getting Ready For A Recovery, as we see it nearing strong support, while finishing a corrective decline by Elliott wave theory.

The Kiwi with ticker NZDUSD woke up last year with a strong reversal on daily chart after a completed larger, higher degree (A)-(B)-(C) correction in B/II, which can be signal for completed deep correction, especially after higher highs and higher swing lows formation up from November 2023 lows.

In fact, there was also some nice accelerating price action through December, which looks like an impulse into wave (1), so more upside can be seen in 2024, ideally after current lower degree A-B-C retracement within wave (2) that can be coming to an end with strong support around 0.59 – 0.58 area.

Well, if the Kiwi manages to recover back above channel resistance line and 0.6220 level, then we can easily confirm a bullish continuation.

For a detailed view and more analysis like this, you may want to watch below our latest recording of a live webinar streamed on April 08 2024:

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

ALTcoins May Resume Higher Soon. Check our blog here.