Silver’s massive rally is driven by falling real interest rates and expectations of Fed rate cuts, which make non-yielding assets more attractive. At the same time, strong industrial demand, especially from solar and electronics, combines with tightening supply and low inventories. Add in rising geopolitical uncertainty and investor demand for safe havens, and silver is seeing powerful upward momentum.

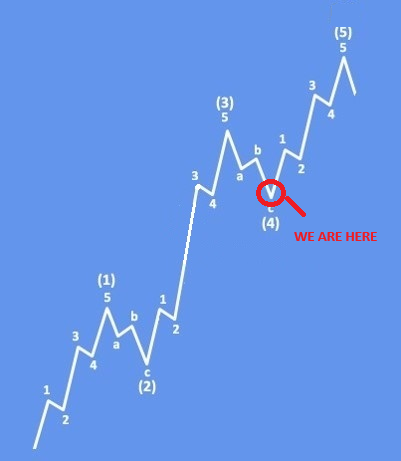

Silver made a strong push higher over the last few weeks before pulling back around 12%. It’s still possible to view this as a wave four within an ongoing, incomplete bullish impulse, so be aware of another leg higher as long as the market trades above the trendline support drawn from August 19. Also note that this wave four has so far retraced about 38.2%, near 48.50 — a key level for a potential new turn to the upside. If bulls hold this zone into next week, we could see a bounce from here, while weakness below 46 would likely signal that silver is entering lower for a deeper and a higher degree correction.

A bullish Elliott Wave five-wave impulse is a price pattern that moves upward in five distinct waves: three in the direction of the trend (waves 1, 3, and 5) and two corrective pullbacks (waves 2 and 4). Wave 3 is usually the strongest, and wave 5 often marks the final push before a larger correction. It signals a strong, sustained uptrend.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.