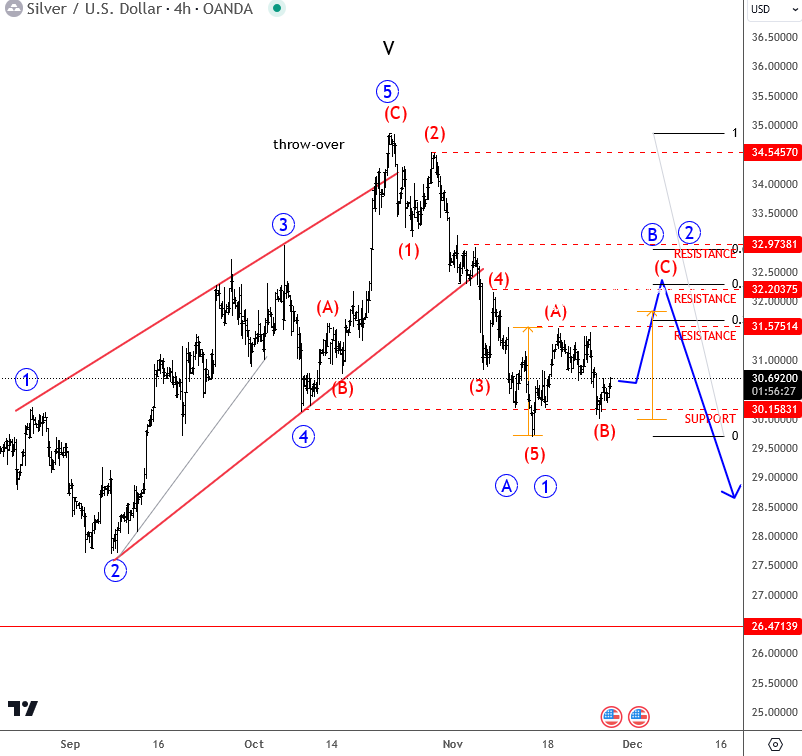

Silver is making sharp reversal down from recent highs, even breaking a lower trendline support of an ending diagonal which is an important indication for a top in place. As such, we are aware of much lower prices, maybe even back to the start of a diagonal at around 27/28 as drop from 4h time frame has an impulsive bearish structure. But we see some bounce now from around $30 swing support, that can cause some relief rally, maybe even sideways move into wave 2/B. Resistance is then around 32-33 area.

For a detailed view and more analysis like this, you may want to watch below our latest recording of a live webinar streamed on Monday 25 2024:

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.