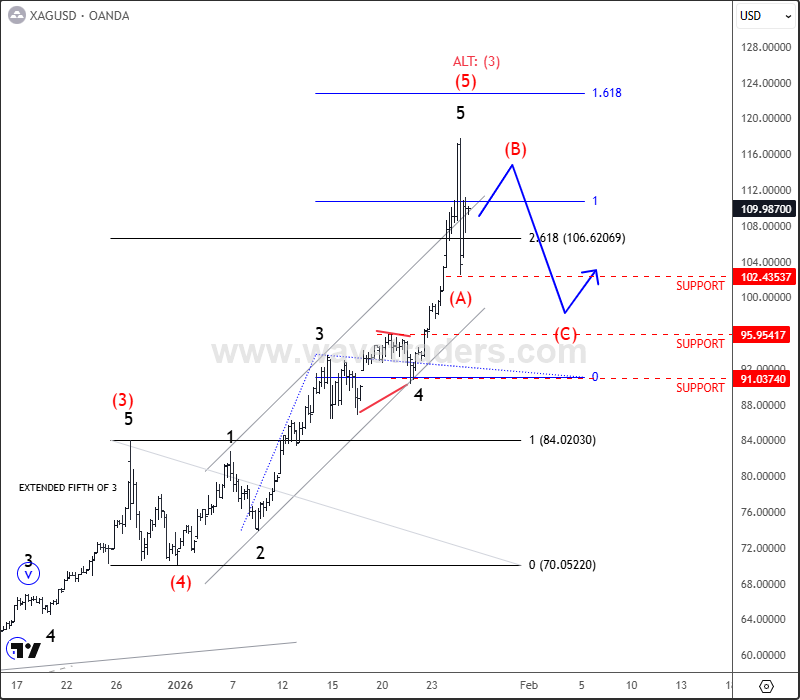

Silver rallied strongly on rising geopolitical risks between Iran and the US, combined with increasing political uncertainty in the US tied to Trump’s pressure on Powell and the Fed. From an Elliott Wave perspective, price appears to have completed a five-wave advance within a higher-degree wave (5) or (3), followed by a sharp reversal.

This reversal suggests the market may now be entering a higher-degree ABC correction, with initial downside potential toward the 102–95 support zone. If selling pressure accelerates, a deeper retracement toward the 90–80 area remains possible. Only a strong and direct continuation higher would favor the alternative scenario that price is still unfolding within wave (3).

On the 30-min chart, Silver turned sharply lower after the final stages of subwave v, confirming short-term exhaustion. The decline unfolded in three waves (ABC), supporting a corrective pullback rather than a trend reversal.

The subsequent recovery was also corrective, signaling a complex correction. Price may now be slowing again within wave (C), with scope for a move toward the 105 area, or even a deeper dip into the 100–95 support zone if a flat correction develops.

Key Levels to Watch

- Resistance: recent highs

- Support: 105, 100–95, then 90–80

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.