Ripple (XRP) continues to trade under pressure as the broader corrective phase unfolds across multiple time frames. Both the 4-hour and daily charts suggest that price action is nearing an important technical zone, but confirmation of a bottom is still required.

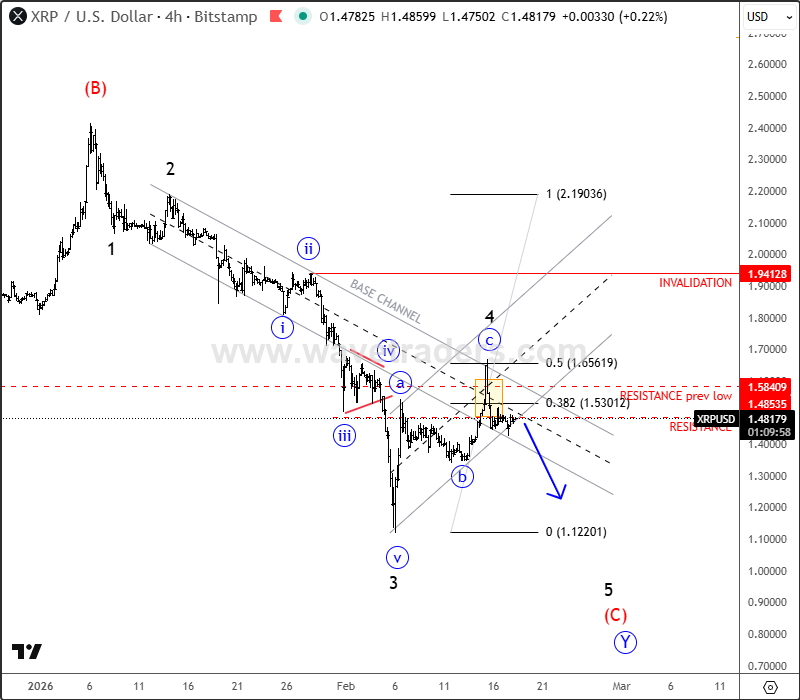

4H Chart – Wave (C) of Y Still Unfolding

On the 4-hour chart, XRP appears to be moving impulsively lower within subwave (C) of wave Y. The structure indicates that there may still be room for slightly lower levels before a complete five-wave decline can be counted.

Following the recent abc corrective rebound in wave 4, wave 5 now seems to be in progress. If this interpretation is correct, XRP could extend its decline toward the strong $1.00 support level. This area stands out not only as a technical level but also as a psychological threshold that could attract renewed buying interest. Below that we have

Until a clear five-wave structure to the downside is completed, the short-term bias remains bearish.

Daily Chart – Complex WXY Correction

On the daily time frame, XRP is trading within a complex WXY correction as part of a larger contra-trend structure. The correction now appears to be in its late stages, with major support seen around the $1.00 zone, followed by 0.8 and 0.6

This level at 1USD is technically and psychologically significant. A strong reaction from this area could mark the end of wave IV. However, the nature of any rebound will be crucial. If price action turns impulsive to the upside, it would signal that bulls are regaining control and that a new upward phase is underway.

Until such impulsive strength is confirmed, the dominant trend on the higher time frame remains to the downside.

In summary, Ripple is approaching a decisive technical area. The $1.00 support zone could act as a foundation for a meaningful rebound, but confirmation through impulsive price action will be key before shifting to a bullish outlook.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.