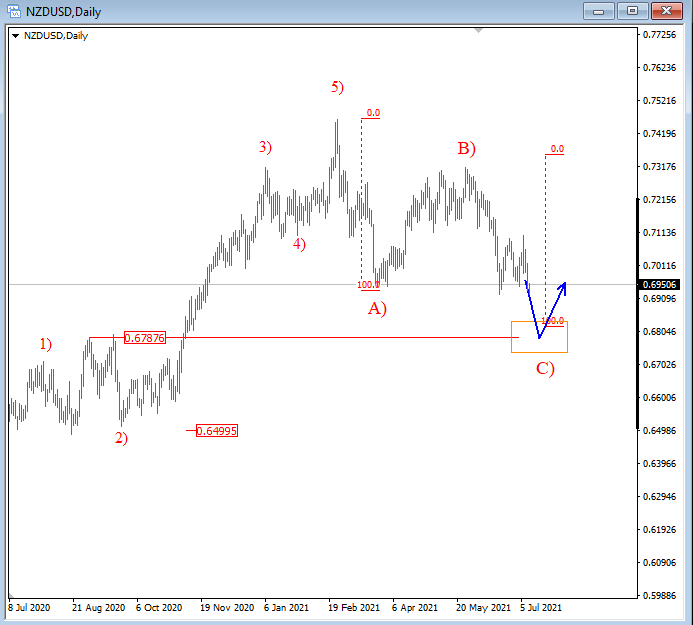

In this article, we will look at New Zealand dollar which is making a very nice retracement as US dollar found support as speculators assume that sooner or later FED will have to fight inflation. However we cannot ignore a very strong bullish trend on New Zealand dollar against the US dollar since March of 2020. We think that this trend is still very strong and valid, therefore we will continue to look higher especially when we have only three-wave move down from a recent top, as shown on a daily chart below where we have projected support at around 0.6790 area. For a potential rally, we will of course patiently be waiting for any intraday impulsive bullish structures to confirm a bullish turn. Patience is key at “do-die” levels.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.