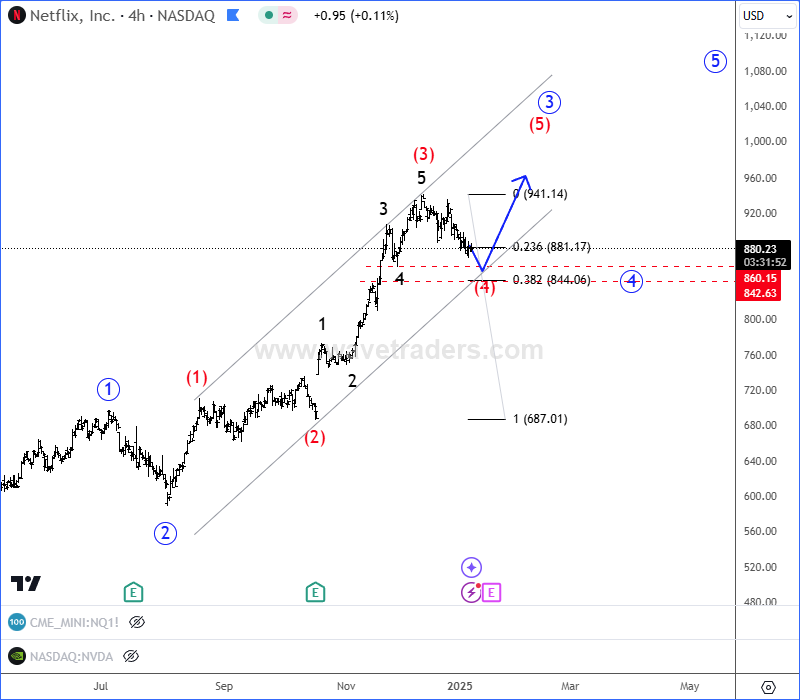

NETFLIX with ticker NFLX is in a massive rally that was even extended in 2024 and looks like there’s space for more upside, because of an incomplete five-wave bullish impulsive cycle. We can see some slow down since the end of 2024 into the beginning of 2025, but looks like a wave (4) correction, which can ideally find the support around 860 – 840 area and from where we should be aware of a bullish resumption within wave (5) towards 1000 area.

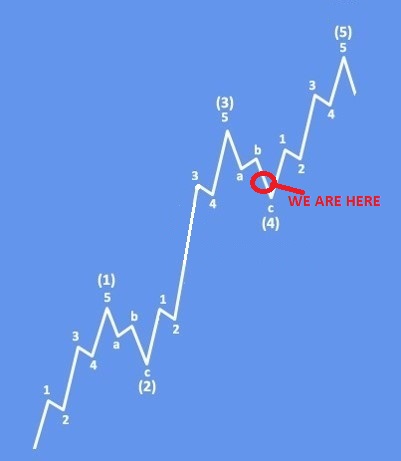

Basic Impulsive Bullish Pattern shows that Netflix can be finishing wave (4) correction and it could resume its bullish trend for wave (5) of a five-wave bullish cycle soon.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.