Tesla’s and Alphabet’s earnings caused a very sharp reversal in the markets this week. It’s important to note that some big-cap stocks like Nvidia were already showing weakness before the earnings of these two companies were released. We’ve been warning about a deeper correction on Nvidia, and it looks like the whole technology sector is now topping out, potentially leading to even more weakness ahead. This could pull down the entire stock market.

“In a bull run, big-cap names pushed prices higher and pulled stock indexes with them, but now the sentiment seems to be changing.”

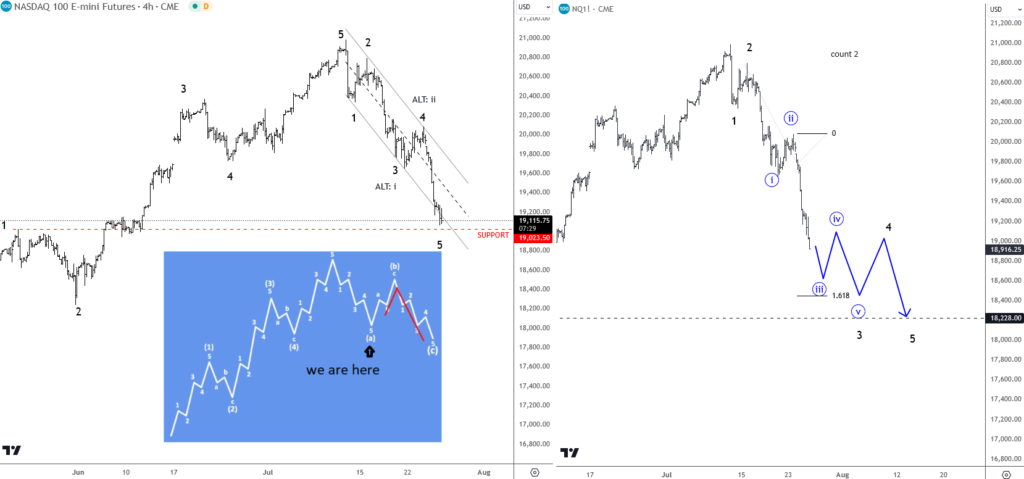

We need to be aware of much more downside in stocks, especially if we look at the NASDAQ 100. We can clearly see that the market is acting impulsively from the highs, with five waves down. Hopefully, prices will stabilize at the $19,000 potential swing support in sub-wave 5 and prevent further selling from here, and rather cause some relieve rally in three legs. However, if we see a move straight to 18,400 from here, it could indicate an extended leg within a much bigger impulsive weakness. This would be very concerning for the markets as a whole.

Make sure to be with us in our webinar on Monday, at 15cet where I will talk about this and lot more. Apply here

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.