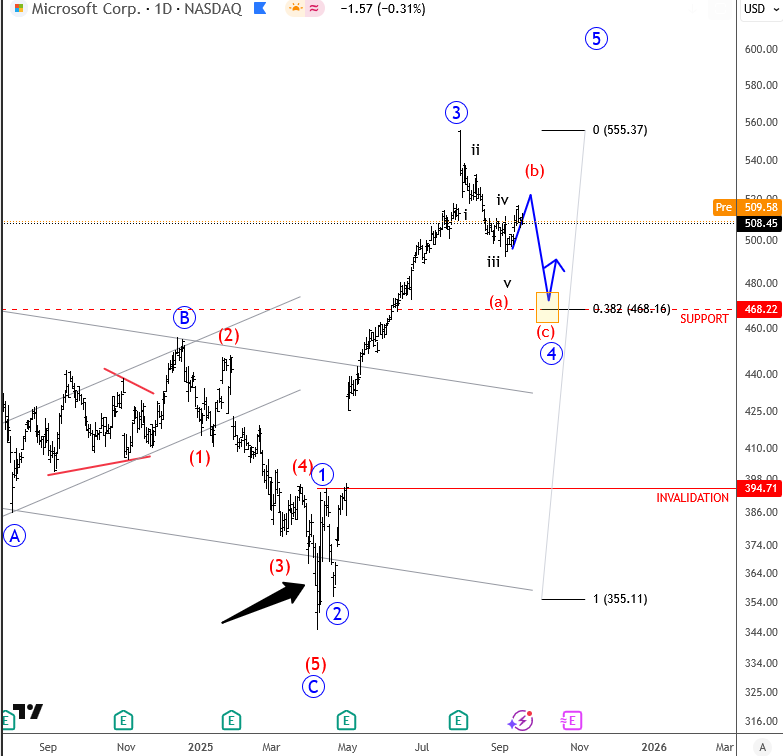

Microsoft (MSFT) has minor five waves down from the highs, so apparently we are still in a higher-degree fourth wave that could be a bit deeper, maybe even pulling back to the previous highs around 468 level. This ongoing fourth-wave pullback could then come to an end near the 38.2% retracement. So if you are looking to join this trend, keep in mind that zigzag is not finished yet.

Highlights:

Trend: Fourth wave correction

Support: 468

Note: Potential zigzag before trend resumes

US Single Stocks Service

Get Elliott Wave US Single Stock updates for some big names and companies