Metals may resume their uptrend after recent corrective decline from technical point of view and by Elliott wave theory.

We have been talking a lot about bullish metals in the past months and they may easily stay in the uptrend, especially now that bonds across the globe are recovering away from the supports.

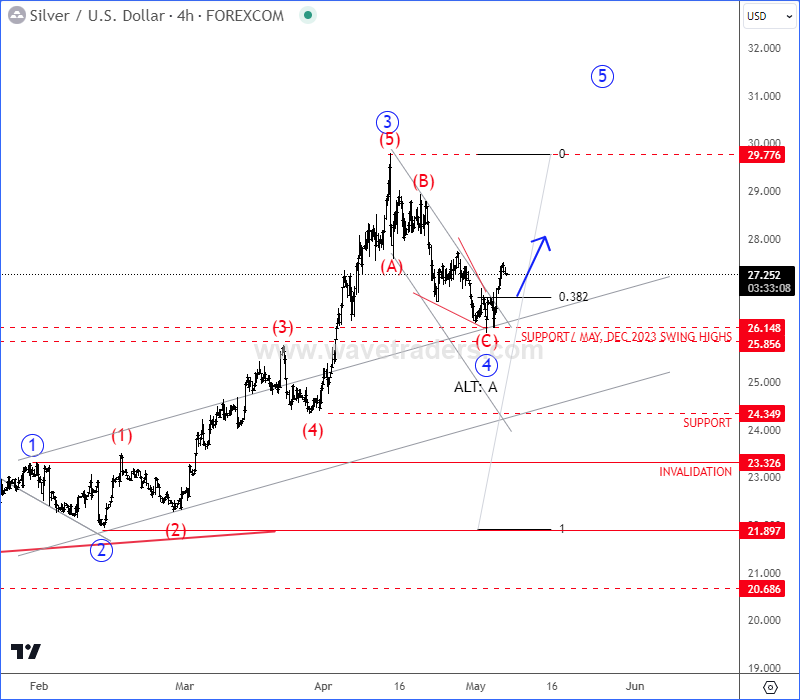

We have seen some slow down on metals recently, but we believe it’s just a corrective setback within ongoing bullish trend, as we see an unfinished five-wave bullish cycle.

If we take a look on gold and silver, we can see a nice three-wave A-B-C correction, which can belong to a higher degree wave 4, so be aware of a bullish resumption back to highs within 5 wave soon.

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Japanese Yen To Stay In The Recovery Mode, While Yields Are Turning From Resistance.

Check our free chart HERE.