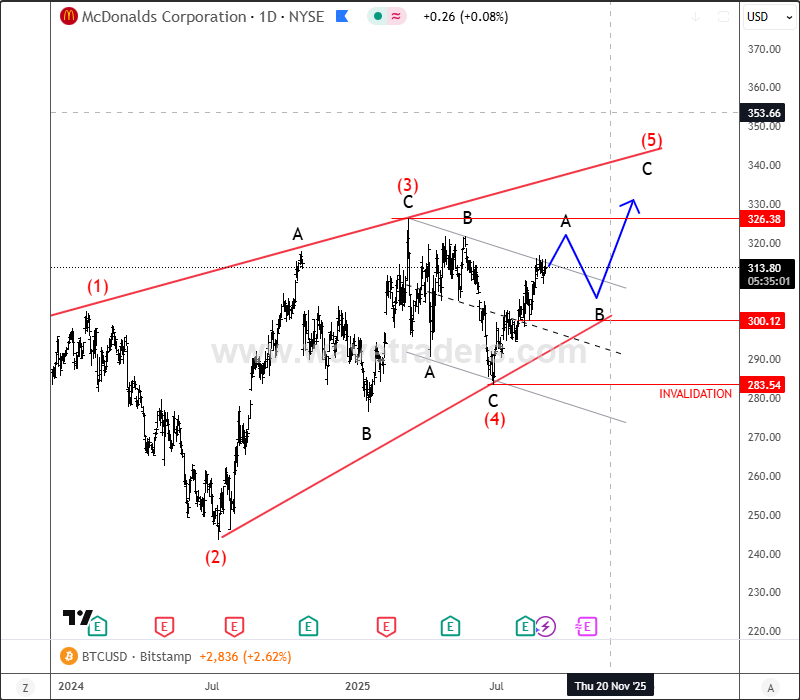

McDonald’s (MCD) is recovering after an A-B-C drop in wave four down to 284, where the correction ended as we discussed last time. It now seems bulls are back in control, especially as price is

retesting the upper trendline of the corrective channel, which in my opinion should be broken in the next few weeks, opening the door for new highs. On dips, opportunities may show up

as wave B unfolds, with support to watch around the 300 round figure. The trend remains bullish as long as the market trades above the 283 invalidation level.

Highlights:

Trend: Bullish after completed wave 4

Support: 300

Invalidation: 283

Note: Retesting trendline; possible breakout

For constant and free access to our US stock coverage, make sure to register and apply for access.

5th report is already available >> https://wavetraders.com/elliott-wave-plans/

US Single Stocks Service

Get Elliott Wave US Single Stock updates for some big names and companies