Good morning everyone. I’m back from skiing, had a great time with my family, and I also shared a few photos in our members only Slack chat room, so feel free to join us there if you’d like.

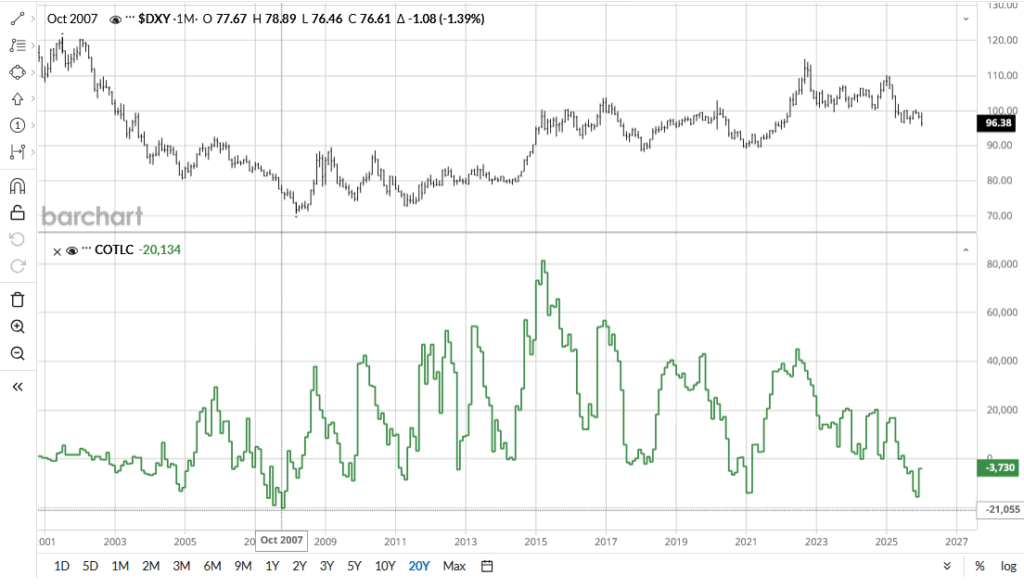

While I was away, the dollar has seen a very strong and extended decline, exactly as we discussed and expected in our previous updates. Dollar weakness has now pushed to new lows, breaking below the 2025 levels, which suggests we may soon be heading into more overextended conditions. This means that at some point we may see some meaningful pullbacks. COT short positioning is close to 2007 extremes, and with recent sell-off this data can be pushed into even more significant levels… Something to consider; what may happen at such levels. Stabilization?

At the same time, there is still a lot going on in the background, including uncertainty and potential escalation between the US and Iran, the risk of a partial US government shutdown, and most recent event was the Fed decision yesterday. The Fed decided to hold rates steady at the first meeting of 2026 as the economy is doing quite well, but there is also strong pressure coming from President Trump toward Powell, which could help stabilize the dollar in the near term if FED losses independecy.

On the other hand, stocks remain firmly in risk on mode. META, Tesla, reported strong results above expectations, and there are also new reports about further investments into OpenAI. So we are still in a phase of strong risk on flows and tech boom. But as said, given how extended the recent legs lower on the dollar have been this week, so some stabilization is likely to show up. But what will cause it, it’s yet to be discovered.

What I think may happen this year with USD, I disscused here in our 2026 video update..

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.