It is too clear and so it is hard to see. A dunce searched for fire with a lit lantern. Had he known what fire was he would have cooked his rice sooner.

The Gateless Gate

Five Stages of the Dollar and Long-term Bull and Bear Phases

The trend is your friend; but sometimes it’s not too easy to see. That being said, your trend depends on the time-frame and though it can be as simple as saying: “prices going up means an uptrend;” or “prices going down represents a downtrend,” it really is so much more. And getting it right, is critical to your P&L.

We do believe getting the long-term trend of the dollar right, for forex traders, regardless of their trading time-frames, can help. In this issue, we take a look at the various stages and phases in the US dollar index from a longer-term perspective.

We are sharing this framework now because if the cyclical trends in the dollar remain intact, since it became free-floating back in 1971 (when President Richard Nixon severed the link between the dollar and gold, ending the Bretton Woods monetary system), we believe we are about to enter the most powerful phase down in the multi-year dollar bear market once current trend is finished.

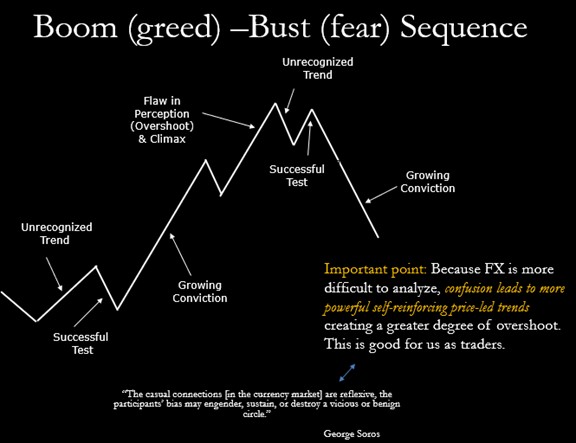

No one can say when multi-year bull- and bear-markets begin and end without that precious gift of hindsight. But we can evaluate setup conditions (or stages in the trend) as they develop, which provides clues about the big trend. We use the boom/bust cycle of price action (depicted below) to help put these longer-term moves into perspective. You will notice, this boom-bust pattern aligns nicely with the Elliott Wave Principle.

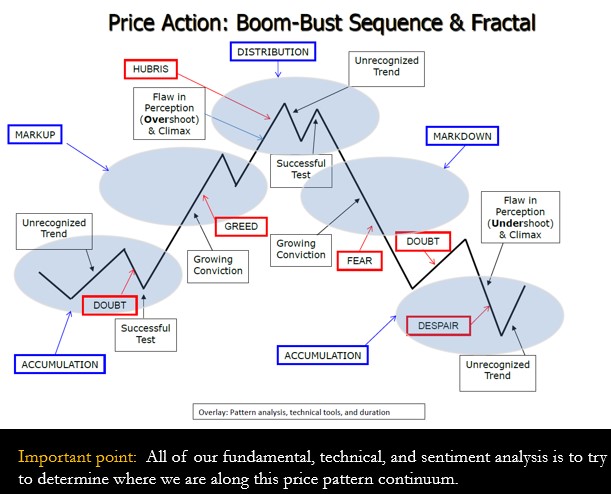

Currencies (as do all actively traded asset classes) move in waves. There are varying labels to describe this price action other than Elliott Waves (ranging from Dow Theory to Woody Dorsey’s Market Semiotics) as you can see below:

But the bottom-line is this: These moves are discernable waves (fractal in nature)—regardless of the terminology.

“Human behavior is the key determinant of markets”

~Woody Dorsey

The waves are generated by human emotion (triggered by expectations) leading to action—triggering real people to move real money. This process represents a complex feedback loop over time because price itself impacts economic fundamentals, just as economic fundamentals impact price, at various stages along the way. Thus, why successful investing and trading isn’t always easy. When it starts to look easy, as we’ve said before, its time to start looking the opposite way of the crowd.

So where are we in this dollar boom-bust continuum? Before we get to that, let’s first put a little meat on the bones of the boom-bust framework from above.

- Stage 1: The unrecognized trend – This is the early on stuff. It represents the beginning of a new trend that is recognized by only a few of the major players. (Elliott Wave 1 or Dow Theory Accumulation)

- Stage 2: The successful test – This is the pull-back that challenges the consensus view, it represents a significant retrace of the prior wave “self-reinforcing” wave. (Elliott Wave 2)

- Stage 3: The beginning of a self-reinforcing process – This is the stage where the consensus begins to realize there are real underlying fundamental reasons why this “new” trend has legs. This is the most powerful and longest leg or wave of the trend. (Elliott Wave 3 or Dow Theory Mark-up)

- Stage 4: The flaw in perceptions – This is the stage in the cycle when some of the major players begin to realize the currency cannot be supported by the fundamentals, as highlighted above. (Elliott Wave 4)

- Stage 5: The climax – This is the final stage of the move, and represents the “overshoot” we often see in currency markets because they tend to be more sentiment driven and price-led than other asset markets. Thus, overshooting fundamental values by a large degree. (Elliott Wave 5 or Dow Theory Distribution)

Rinse and repeat to the downside.

Each of these five stages of the dollar is incorporated within either a complete multi-year bull or bear market move. We list them below.

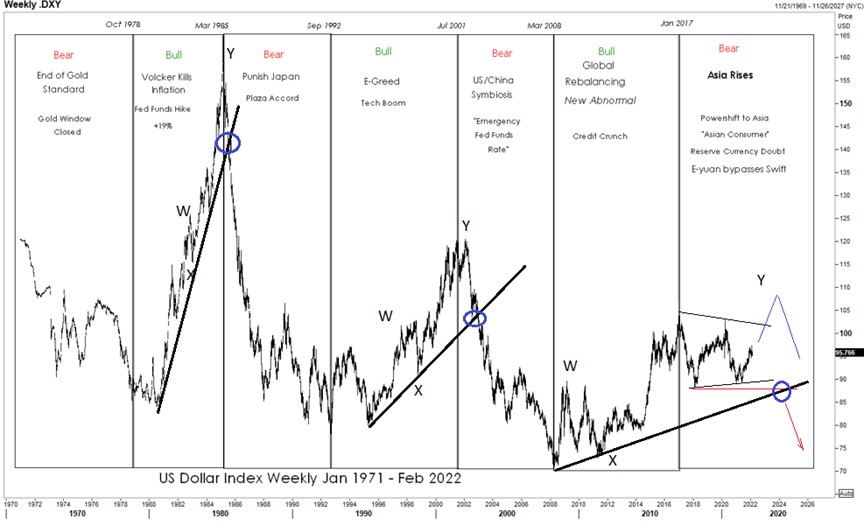

Full bull- and bear-moves in the US dollar index have ranged from six to eleven years (10 ¾), since the inception of the free-floating currency market back in 1971. We list each below, with an applicable major fundamental macro global rationale for the change in trend. (Note: rationales are best guesses in hindsight. But we do know that major global macro events are triggers/concepts responsible for longer term changes in trend).

1971-1978: Seven-year bear market (President Nixon closes the gold window closed)

1978-1985: Six-year bull market (Fed Chairman Volcker squeezes inflation)

1985-1992: Seven-year bear market (Plaza Accord aka punish Japan)

1992-2001: Ten-year bull market (E-Greed aka Tech Boom)

2001-2008: Seven-year bear market (US/China Symbiosis)

2008-2017: Eleven-year bull market (Global Rebalancing aka Credit Crunch)

2017-?: Sideways price action then bear? (Asia Rises aka Powershift of global capital to Asia)

Here is our long-term chart showing the various bull and bear market phases in the dollar index; we have added the current Elliott Wave count to the bear market expectations.

We suspect that dollar is in a corrective price action from 2008 low, another W-X-Y like in previous two cycles; first since start of 1980 and then second since 1993. The big downtrend may resume when trendline will be broken near 87.00-88.00. So until that happens, 105 can still be retested, which may actually depend also on the situation of the euro. So even 105 retest may not be bull for the USD, because we believe that other currencies will still be strong, like AUDUSD per example (for AUDUSD click here).

The trigger for DXY weakness, most likely, will be an accelerated shift in capital flow out of the Western “democracies” and into Asia (led by China of course). That shift is already well underway.

Granted, this type of analysis may be less helpful if you are a short-term trader. But, if we are right about the next major move lower, it will provide a consistent and clear bias for years to come. We have found getting the longer-term trend bias right significantly increases the probability of success, regardless of time frames we trade.

We hope this broad overview is helpful, or at least, interesting to you.

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.

Register for EW-Forecast Macro Views

Regards,

Gregor and Team…