The causes of all panics, crashes and depressions can be summed up in only four words: the misuse of credit.

Ludwig von Misses

Band of Clueless Brothers, spreads, and bull markets…

In our last missive we warned of a coming risk-bid. Well, we are still in the midst of it we suspect. How long this decline lasts is anyone’s guess. But sooner or later we will witness a real bear market and the recent Fed meeting may have given us a hint.

Below is a weekly chart of S&P 500 E-mini futures (ES); showing an unprecedented 121.17% explosion upward in price since March 2020 (we have placed some common Fibonacci retracement levels on the chart):

Usually, markets consolidate or correct gains. This one will be no different.

Thing is, there are so many people playing this market who have never traded or invested during a bear market phase. These newbie traders boldly proclaim they aren’t afraid; they will be buying those dips, raking in all those “bargains.” This is the crowd that qualifies nicely for the old adage, attributed to the great Humphry B. Neill:

…as the bear will always follow. We just don’t know when, but as we said, maybe Mr. Powell and his “Band of Clueless Brothers” on the Federal Open Market Committee (FOMC) just gave us a hint.

The big takeaway from Chairman Powell’s comments last Wednesday afternoon was the Fed will be quite aggressively draining the punch bowl because they are very worried about inflation. They are so worried they haven’t started draining anything from the Fed Balance Sheet just yet. Hmmm….

Credibility point #1.

What struck during the news conference was Mr. Powell’s continuous exclamation: “The job market is very strong.” We’d beg to differ. It may be strong among the elite techno-skilled crowd who hangs around the “Band of Clueless Brothers”—but that isn’t the real-world boys and girls.

- The job market is not strong as Powell claimed it was due to a strong, healthy economy. It is tight because a huge part of the labor force quit for good in total disgust, leaving us incapacitated in production. Many of those retired for good (even Powell admits that) because their companies were destroyed by our various COVID lockdowns over the past two years. They were close enough to retirement that retraining or relocating made no sense to them. The job market has been made even tighter by the unconstitutional Biden vaccine mandates and then again by Omicron sending many out on temporary sick leave. All of those mean the market is NOT strong and healthy because of a growing, vibrant economy, as Powell claimed, but is tight because of economic ruination!

- The businesses that closed because of the COVID crisis stand out like enduring economic ruins on the landscape. They do not just represent a permanent loss of jobs, leaving more people taking from the government via social security than giving into it. They are also permanent waste of productivity littered around the nation. Those particular businesses are never coming back, and in the present plague-ridden environment, new production or service businesses will be slow to get going. (I mean who really wants to open a restaurant or hotel at a time like this when many establishments are still forced to run at partial occupancy or to turn patrons away who are not vaccinated because of local vaccine mandates?)

The Great Recession Blog

Credibility point #2.

Mr. Powell was quite candid on the supply chain problems. And seemed quite conflicted on the point of rising inflation caused by supply chain problems and how rising interest rates might help this problem dissipate. Of course, the only way rising interest rates help alleviate a supply problem is to reduce demand, or economic growth; and further pressure the job market we don’t believe is “very strong.”

Credibility point #3.

Given the aggressive expectations for rate hikes next year, Mr. Powell tried not to explain how a stock market juiced on pure liquidity will withstand two liquidity drains, one on top of another; i.e., rising cost of capital (rates) and Qualitative Tightening (off-loading Treasury bonds). Does this mean the Fed will actually focus on its so-called “price stability mandate” above all else and risk a very negative feedback loop of crashing stocks in an already fragile global economy? Doubtful.

Why not start to reduce the Fed balance sheet now, and see how interest rates start to react before committing to aggressive interest rate hikes and QT at the same time?

This would seem to make sense. It would give some grace period to allow the market to clear these supply chain disruptions naturally, which will likely reduce inflation expectations.

Credibility point #4.

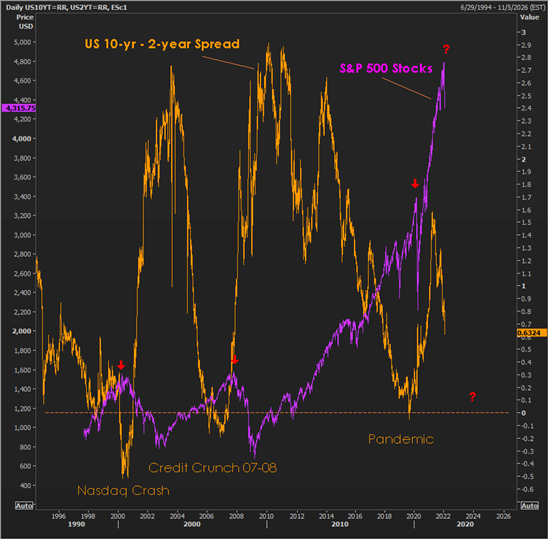

The reaction to the Fed news conference last Wednesday was met with a swift decline in the spread between US 10-year benchmark rates and US 2-year benchmark rates; referred to as the “two-ten spread.” (See the yield curve primer box below).

When the spread declines, bond guys say it represents “curve flattening.” This is not a sign of confidence. It suggests the bond market, the best arbiter of future economic growth and inflation prediction, is expecting lower growth and inflation going forward.

As we have said before, Mr. Consumer is pulling in his horns. And as we said above, the job market seems a lot weaker than the Fed suggests. All of this suggests growth may surprise to the downside going forward (latest GDP growth though strong. Appeared “front-end loaded with big inventory build). All of this suggest the 2-10 spread is likely to decline. And you may notice that as the 2-10 spread declines, approaches zero and or “inverts” (10-yr rates falling below 2-year rates), bad things happen in the stock market. The last three times the 2-10 spread approached zero we got the Nasdaq crash, the Credit Crunch, and Pandemic.

So, if you still like stocks, we would recommend the following:

- Keep a close eye on the technical setup; which we continuously update.

2 .Watch the path of the 2-10 spread.

3. Don’t confuse brains and a bull market

A basic primer on reading the yield curve:

Investors analyze the shape of the yield curve and the changes to its shape to gain a sense of what to expect of the economy in the near future. The yield curve steepens when the market foresees certain trends. These include stronger growth, higher inflation, and an increase in interest rates by the Federal Reserve. “Steepening” means that the yields on longer-term bonds rise more than the yields on short-term bonds.

On the other hand, when investors expect weaker or slower growth, a lower rate of inflation, and lower interest rates from the Fed, the yield curve often flattens. In this case, the yields on long-term bonds fall more than the yields on short-term issues.2

One of the most common ways to measure these changes is to compare the yields between the 2-year and 10-year T-notes. The chart below shows this spread over time.

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.

Register for EW-Forecast Macro Views

Regards,

Gregor and Team…