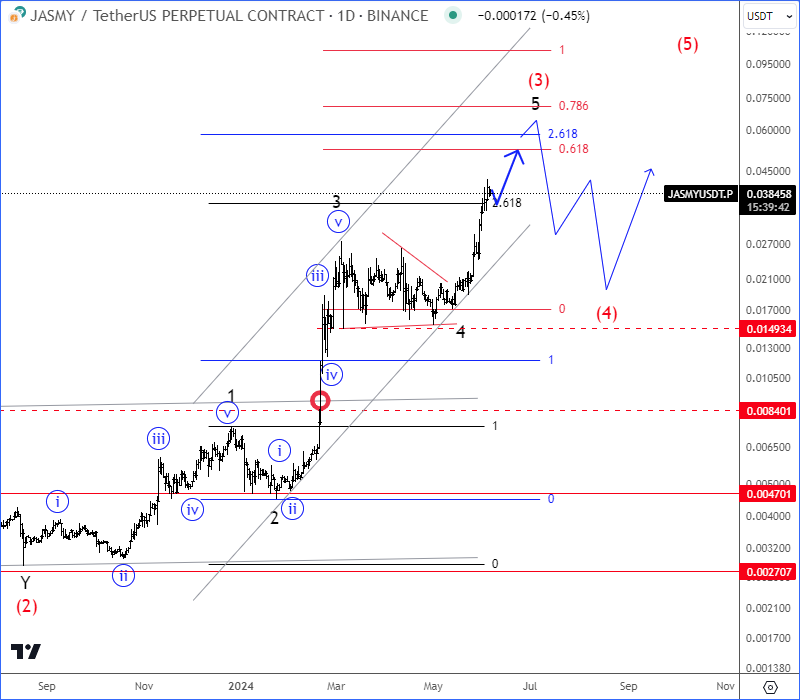

We talked about Jasmy already back in May, where we mentioned and highlighted an ongoing five-wave bullish impulse that can be still in play. CLICK HERE

Later on June 06 we updated the chart for our members, where we spotted final stages of wave 5 of (3) and we warned about a new higher degree waver (4) correction that can retrace the price back to the former wave 4 area.

As you can see in the updated chart from July 10, it nicely turned down for wave A of a higher degree A-B-C correction within wave (4) and we pointed that wave C is still missing and it can retest the ideal and strong support at 38,2% Fibo. retracement and 0.015 area after wave B rally.

Later in August, Jasmy finally completed its three-wave A-B-C corrective pullback in wave (4) at the perfectly projected textbook, former wave 4, 38,2% Fibo. and 0.015 support area. This is where we started to look for a bullish resumption within wave (5).

Today on September 25, we still expect a bullish continuation within higher degree wave (5), especially if jumps back above channel resistance line and 0.034 bullish confirmation level.

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.