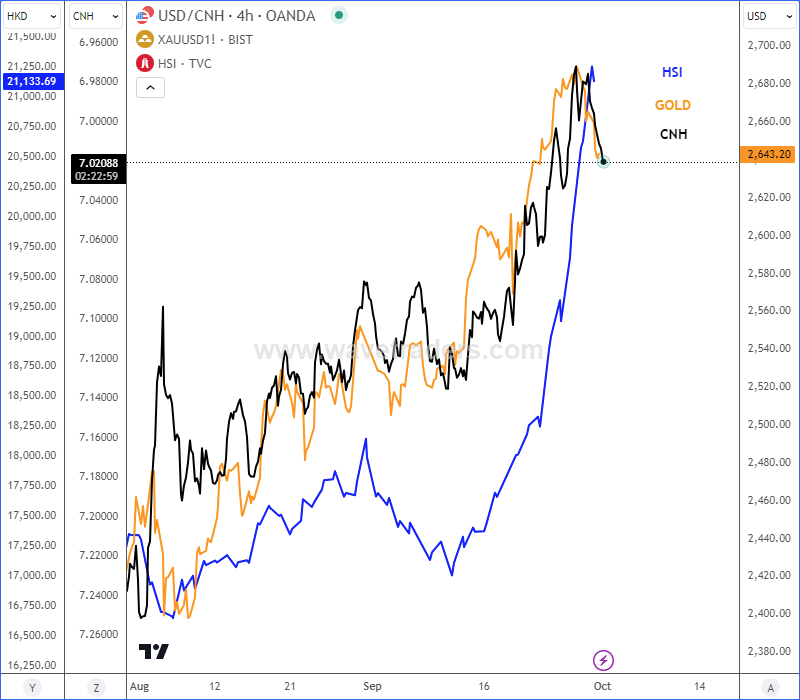

Gold is trading bullish already for a while and we have been talking a lot about that in the past. By recent China stimulus package, we can see Chinese stocks like Hang Seng Index (HSI) in a massive rally and at the same time Chinese yuan is getting stronger as well which is positive for metals. So, ff we respect a positive correlation with gold, seems like gold is going to stay bullish as we see more upside potential on HSI.

Looking at the 4h time frame; Gold is accelerating higher on China stimulus, and from Elliott wave perspective it’s most likely in wave (3) of an extended wave 5. As long as the price is above 2532 invalidation level, we should be aware of more gains for wave (5) of 5, after current wave (4) correction that can stop at 2620 – 2600 support area; a perfect zone for next bounce.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.