As you may have noticed, gold has seen a sharp reversal in recent weeks, and many traders and investors are now wondering whether this correction will be quick and shallow or last longer. To get a better clue, it helps to look at some correlated markets — for example, the dollar versus the Chinese yuan. When we compare the two, it seems that gold’s correction could last a bit longer. On USD/CNH, we can see five waves down, which usually means the market will then recover in three waves. So far, this latest recovery looks like an unfinished A-B-C rally, suggesting that more upside may still come on the USDCNH pair. If that happens, metals could remain trapped in consolidation for a while longer.

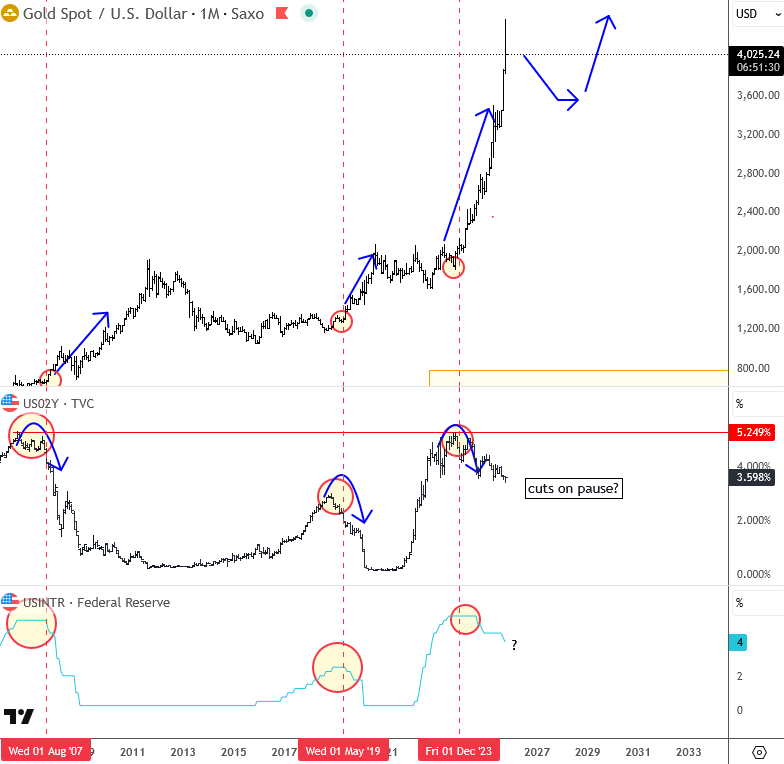

We also need to consider US monetary policy. Powell didn’t convince markets last week about further cuts in December, so if rates stay on hold for the next few months or even longer, gold may continue to pause. The metal usually rallies more easily when expectations for rate cuts rise, not fall. So, both from a macro and wave perspective, this likely fits as a higher-degree fourth-wave correction. Overall, this correction could last longer, and once deeper prices flush out late buyers and weaker positions — possibly in the coming months — that’s when we’ll likely be more confident calling for the next major leg higher, ideally early in 2026.