We talked about bullish GrayScale Bitcoin Investment Trust (GBTC) already back on February 28th with a weekly free chart, where we mentioned and highlighted an ongoing five-wave impulsive bullish cycle. CLICK HERE

Well, as we actually expected, after GBTC reached all-time highs, we can see a projected slow down that looks like a wave (4) correction.

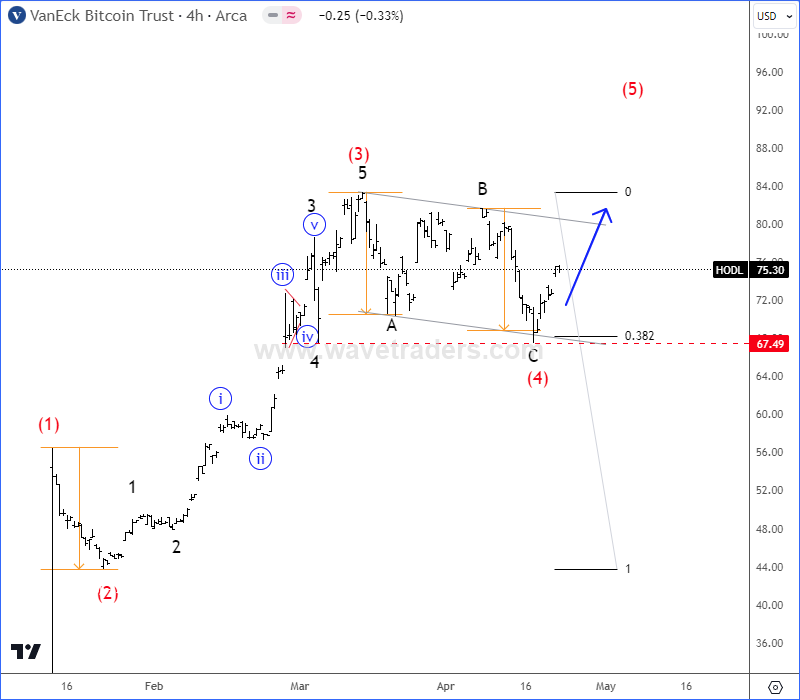

A correction actually occurred a month before the Bitcoin halving and finished right before the Bitcoin halving. And, as you can see now in a closer, 4-hour chart after the halving, GBTC is bouncing from projected support after a completed A-B-C correction in wave (4), so wave (5) is now in progress, which can easily lift Bitcoin price back to highs as well.

Even new-listed VanEck Bitcoin Trust ETF (HODL) is looking for a bullish continuation within wave (5) of an impulse from the lows after recent nice and clean A-B-C correction in wave (4).

For a detailed view and more analysis like this you may want to watch below our recording of a latest live webinar streamed on April 22 2024:

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Microstrategy Slowed Down For A Correction Along With Bitcoin. Check our free chart here.