Crypto market has experienced a strong sell-off in the last week or so, after an announcement that Germany’s government has been selling hundreds of millions of dollars worth of bitcoin in the last few weeks; 900BTC in June, then 3K BTC last week and an additional 2739 BTC on Monday. This obviously causes a lot of fear on the markets, but this can be moving into some extremes now so be aware of stabilization at 50k-55k on Bitcoin.

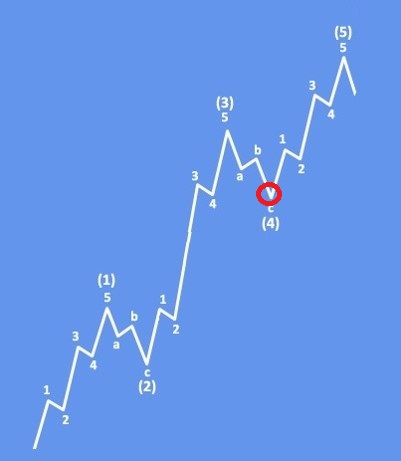

Looking at Grayscale Bitcoin Trust ETF with ticker GBTC, outflows sent price to lower support and from Elliott Wave perspective it can be just making a corrective pullback after retracing down from all-time highs. It seems to be moving now into late stages of an A-B-C correction in wave 4 that can resume the bullish trend for the 5th wave soon. We also see that around 45-50 zone, wave four equals to wave two, near the trendline support connected from 2023 lows which certainly suggests that the bull trend is not being broken yet.

Based on a basic Impulsive Bullish Elliott Wave Pattern, it appears that GBTC can be still in the middle of an ongoing correction within a higher degree five-wave bullish cycle that can resume soon.

For a detailed view and more analysis like this, you may want to join our live webinar today on July 09 2024 @ 15.00CET

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Silver Resumes Its Bullish Trend. Check our free chart HERE.