Hey Traders,

I hope everyone have a good day.

In this article, we will take a look at the USDJPY, which is experiencing a very strong and sharp reversal from above 162-164 area. One of the reasons for this current sell-off is the weak US dollar, especially after the inflation figures softened in the US as reported last week. Additionally, Japan’s intervention in the FX markets is playing a significant role as well. Japan is serious about turning the Japanese yen around and has intervened in the market, leveraging the momentum from the recent US CPI figures. Their efforts seem successful so far, as after a significant drop to 158 last week, we are seeing even more downside pressure. The Japanese finance ministry has also reported that they will fight against speculators if there is any further weakness in their currency.

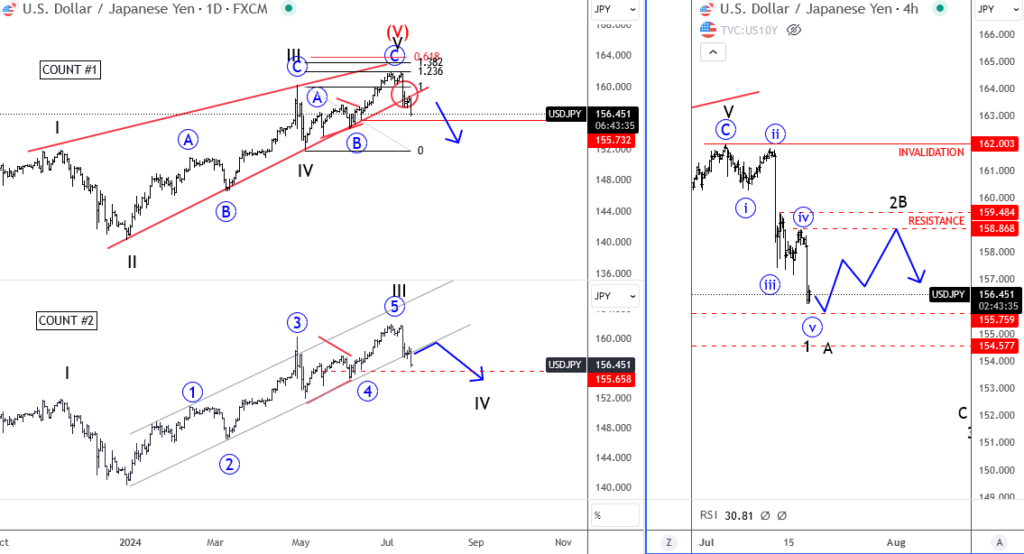

In our eyes, this reversal is not surprising either. In Elliott wave terms, we have been tracking two wave counts. The first one showed a wedge formation, while the second indicated a potential completion of an extended wave three from December 2023. Both wave counts on a daily charts, suggested limited upside.

More importantly, if you look at the 4-hour timeframe, you can see a five-wave drop from the start of this month. In Elliott wave terms, whenever you have five waves from a new high or low, it indicates that something is changing. In our case, this structure suggests that the USDJPY could move even lower. However, markets never move in a straight line, and there will be pullbacks. Ideally, we will see some corrective rally still, possibly into Wave 2 or Wave B. Either way, there should be resistance around the 159 to 159.40 area.

If someone wants to take advantage of the potential weakness, it might be a good idea to wait for some rallies first. The initial support that could limit the current sell-off is seen at 150.70, followed by the 154.50 area.

I hope you enjoyed this article. If you want to join our services and receive regular updates on the USDJPY and other major markets, make sure to check out our services.

Grega

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.