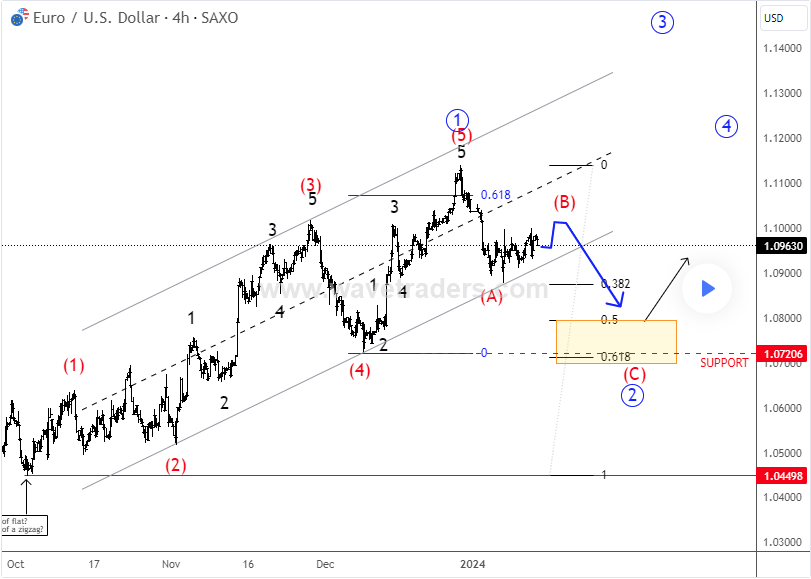

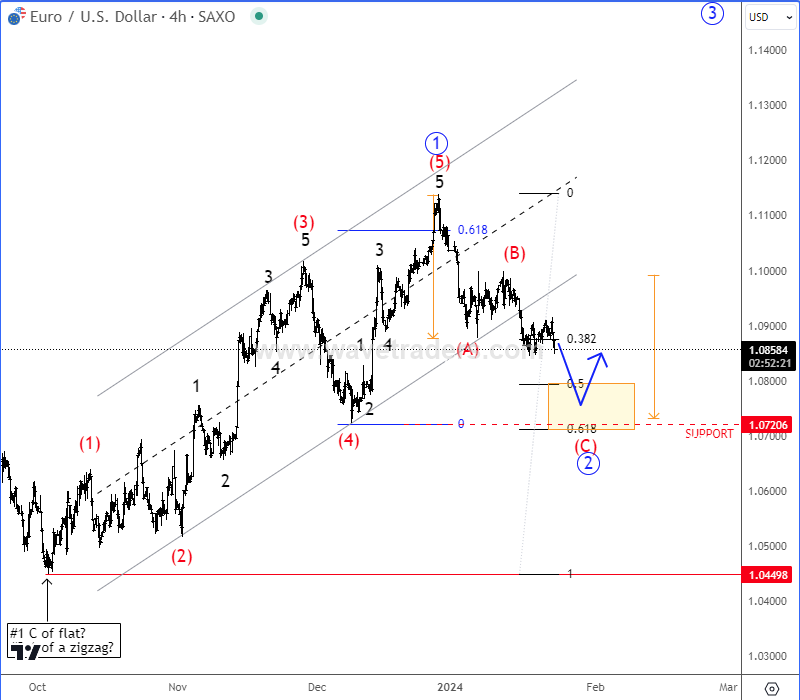

EURUSD: Elliott Wave Corrective A-B-C Setback Is Coming Into Big 1.08 – 1.07 Support Area ahead of ECB policy decision.

Euro turned up at end of 2023, it recovered with a sharp reaction higher up to 1.1 area where pair slowed down and turned lower into an (A)-(B)-(C) pullback as expected. We talked about this one here.

As you can see today, price is coming down nicely as expected, ideally into wave C of a corrective setback that can represent even wave 2 so be aware of price stabilization, maybe still this month, probably somewhere in at the 1.08 – 1.07 area.

Also keep in mind that ECB is much more hawkish than FED, so possibly pair will stabilize already this week when ECB can highlight its hawkish bias on Thursday. But it’s not only that, we are also watching US yields closely. Three legs up on the 10 year US yields from early January can be a bearish setup, which can send the US dollar which can then be supportive for the EURUSD pair, especially if US yields will fall faster than one on Europe. Also, lets not forget that stocks are already trading higher, so are Eur, Gbp, Aud and other currencies going to catch up the bulls?

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.

Stocks Surge, Awaiting USD and Yield Shifts as Key Economic Data Looms. Check our recording of a latest live webinar HERE.