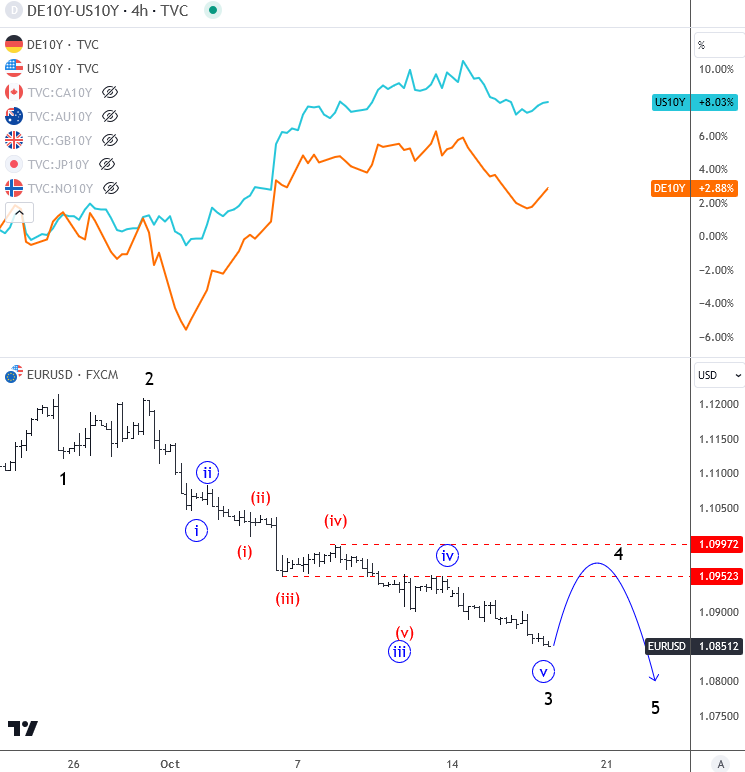

Today is set to be a very important day for the eur, as the ECB is expected to cut rates by 25 basis points. EUR/USD has been very weak over the last two weeks, and this ongoing impulse suggests there could be more downside ahead, especially after any rebound. Sometimes, we see rebounds driven by a “buy the rumor, sell the news” effect.

Considering the recent sharp decline in EUR/USD, it’s likely that the expected rate cuts are already priced in. So, even if the ECB cuts, we could see some stabilization in the euro. However, after a three-wave rally, we still anticipate further weakness.

The euro’s direction will also depend on the yield differential between the US and Germany. If US yields rise more sharply than German yields, this would likely keep EUR/USD in a downtrend. If my analysis is correct, and we get some bounce, I’d be looking to sell rallies, but we would need to see a rebound in three legs, to at least 1.0950 or ideally up to 1.10, which aligns with the termination area of the previous fourth wave based on two counts that we are tracking with members.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.