EURGBP is coming lower as anticipated, ideally within an impulsive five-wave decline for wave (C), where final wave 5 can be in progress after we spotted wave 4 correction.

We talked about bearish EURGBP pair a lot in the past weeks. Firstly we shared an article back on April 16th, when we spotted a bearish triangle pattern and then also on May 22nd, when we noticed a completion of a bearish triangle pattern on a daily chart. Since then, EURGBP actually remains nicely bearish within a five-wave bearish impulse for a higher degree wave (C).

Today we want to share an educational article on how we have been following one of the past waves of an impulsive five-wave decline in the 4h time frame chart.

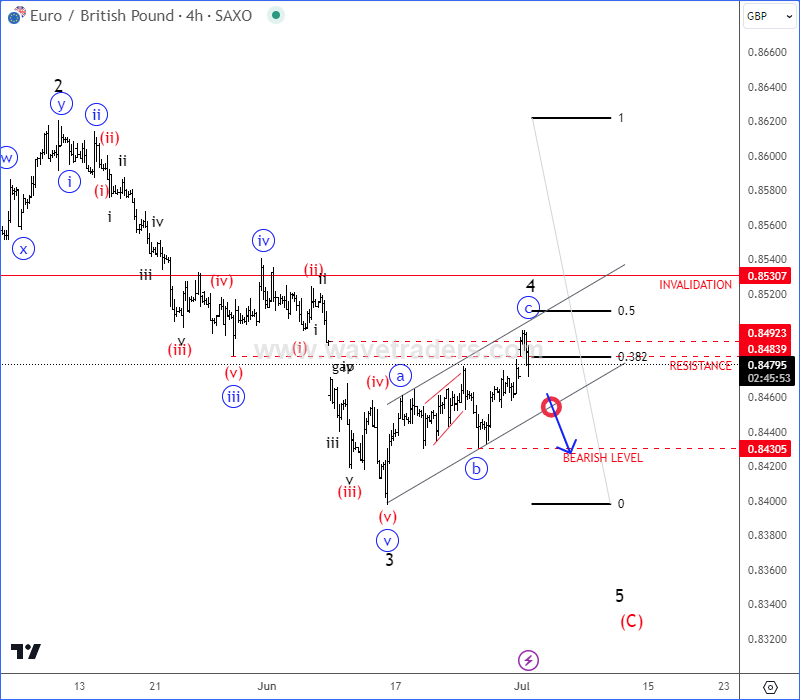

If we go back to June 27th, we warned our members of an unfinished five-wave impulsive decline within wave (C), so we were tracking an a-b-c corrective rally in wave 4 with nice and key resistance around 0.8500 area.

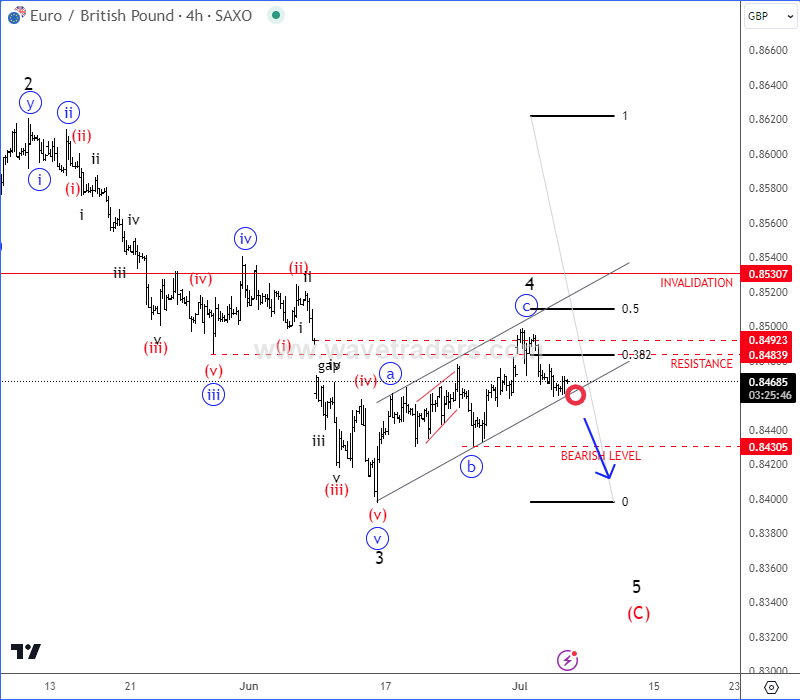

Later on July 1st, we noticed a completed a-b-c correction in wave 4 and pointed for a bearish continuation within wave 5.

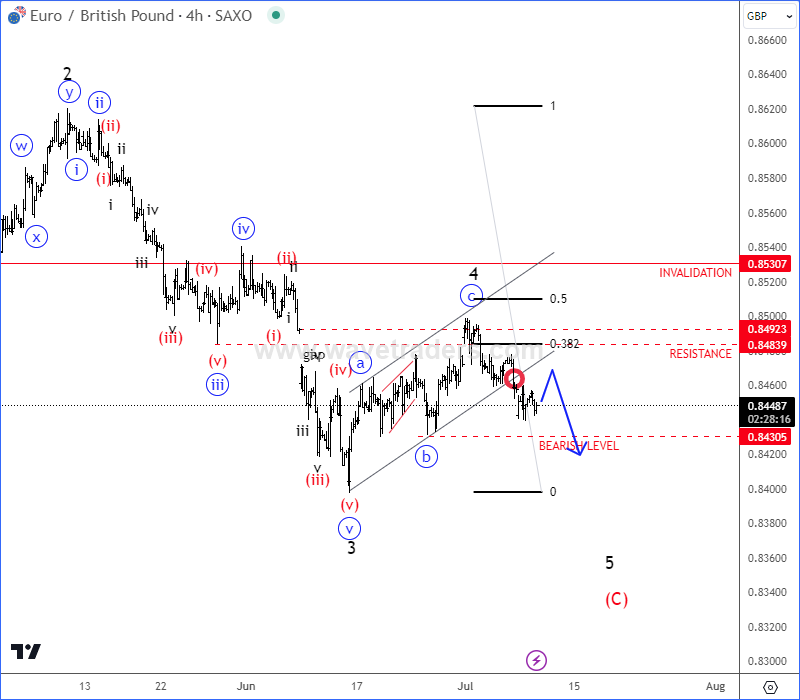

Then again on July 4th, EURGBP came even lower, but we mentioned and highlighted that we need broken channel support line to confirm an ongoing 5th wave.

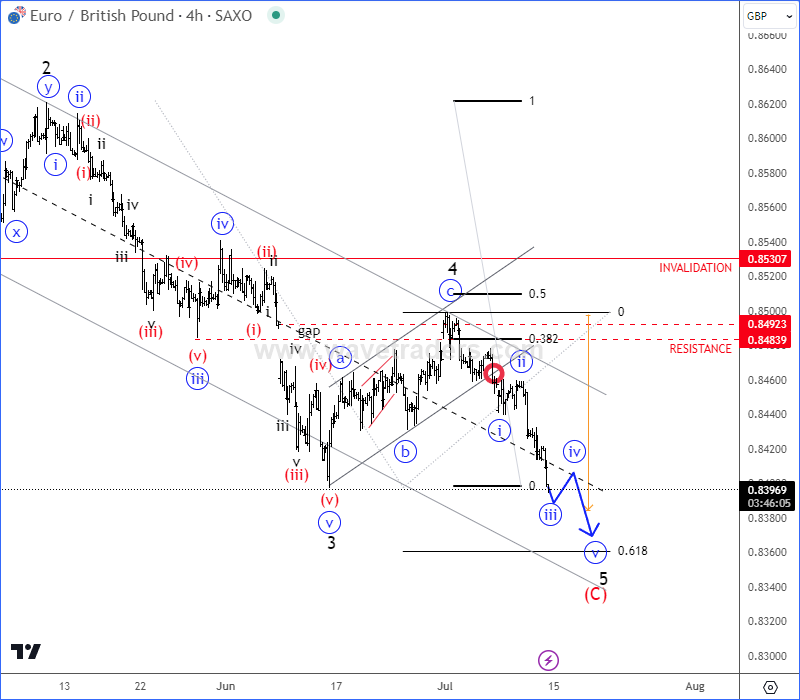

Going further, on July 9th we saw a break below channel support line that was a confirmation for a bearish resumption within wave 5.

And now finally today on July 12th, EURGBP pair is back to lows for 5th wave as expected, but we still space down to around 0.8350 area to complete a five-wave cycle of the lower degree before it finds the low.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Dollar Holds 104 Support (For Now) Amid Stock Market Rotation? Check our blog HERE.