Ethereum is pointing higher, as we see it recovering in an impulsive fashion, after completed three-wave A-B-C correction by Elliott wave theory.

Ethereum with ticker ETHUSD is waking up from projected support after a completed A-B-C corrective decline. With an impulsive recovery back above the channel resistance line and 1900 level for the first wave 1, seems like bulls are back, thus we expect more upside for wave 3 of a five-wave bullish cycle after current pullback in wave 2. Nice support is at 1800-1840, while invalidation level is at 1625.

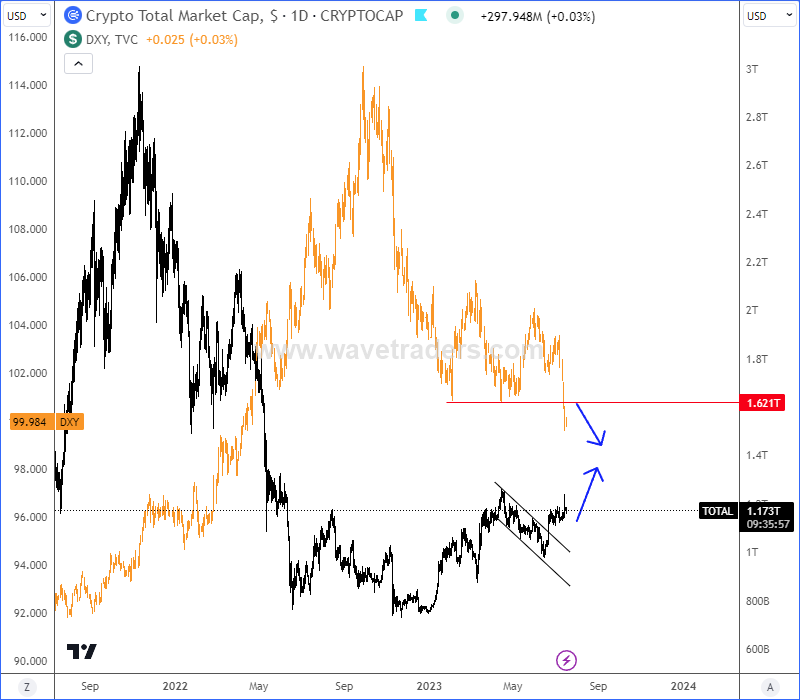

One of the main reasons why Ethereum could stay in the uptrend is US Dollar. Notice that US Dollar Index – DXY is breaking sharply lower after inflation cooled down to 3% as reported last week, which can easily cause a bigger recovery for the cryptocurrencies in general as speculators can be looking for more dollar weakness and limited upside on US yields as they believe that FED is very close to end the hiking cylce.

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.

DAX Has Room For More Upside. Check our free chart HERE.