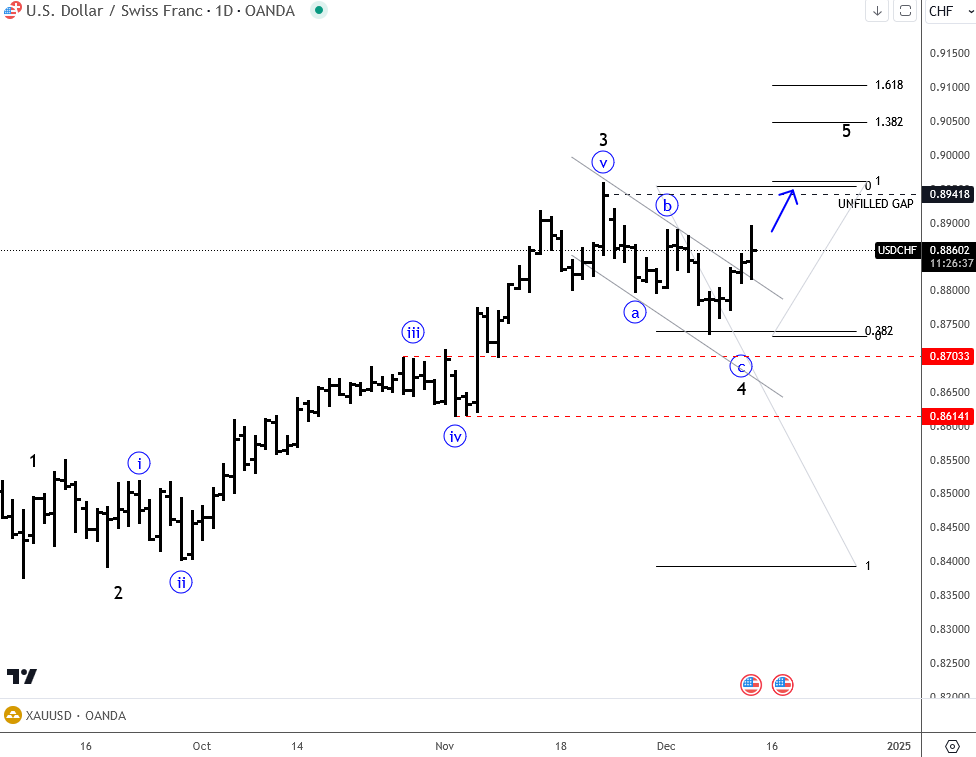

From an Elliott Wave perspective, this drop was tracked as a three-wave correction, suggesting it was part of a broader uptrend. The potential for a continuation higher was supported by the incomplete Elliott Wave bullish pattern and the presence of an unfilled gap near recent highs, which remains unfilled today.

The Swiss National Bank’s surprising 50 basis point rate cut further bolstered the pair’s bullish outlook. The SNB chairman also hinted that additional rate cuts could be on the table heading into 2025, adding to the Swiss franc’s weakness.Technically, the break above channel resistance signals that a fifth wave is underway, potentially targeting the 0.90–0.91 area. This zone could mark a limited upside later this month or in early January when the broader US dollar cycle may conclude as Trump takes office.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.