Hey everyone, hope you enjoyed the weekend.

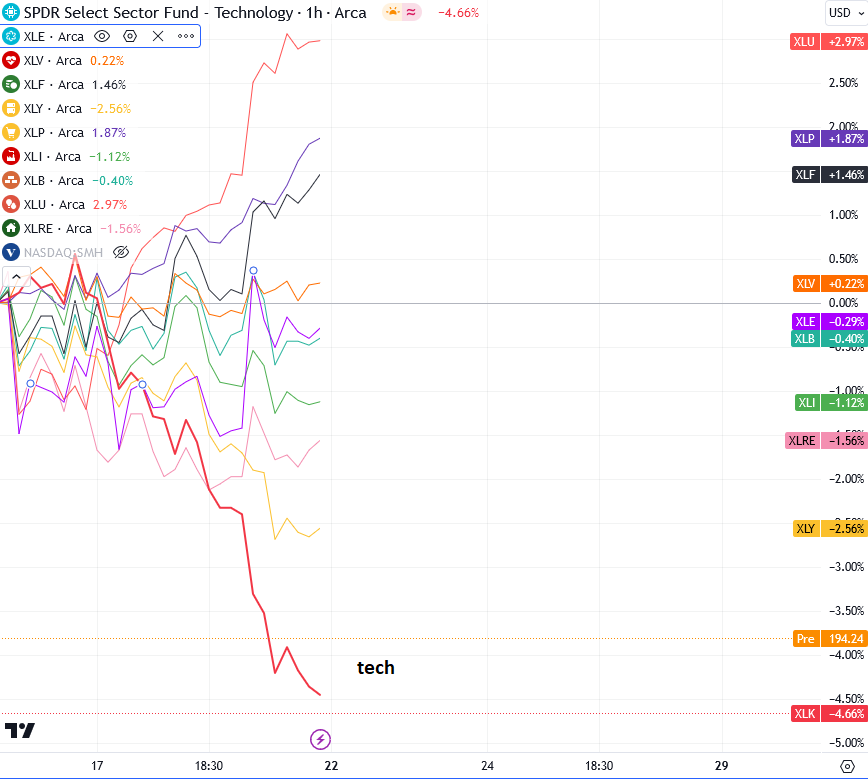

As you know stocks came down last week, as inflation can stay stuck at current levels, meaning that FED may not be ready to cut rates just yet, and then you also have conflict in the Middle East between Iran and Israel. However, this escalation between Iran and Israel calmed down in the last few days, which is also visible through |crude oil that came back 81 area in recent trading session. If crude stays more sideways and slow here in this range, without any new escalations in the Middle East, then the stock market may see some stabilization I think, while metals can test a bit lower supports. Gold has a nice support at $2300. Cryptos also made some nice recovery through the weekend, pointing to more upside after halving, despite lower technologies, while the dollar slows down a bit. However, the dollar can be volatile again due to US PMI and GDP data on Wednesday and Thursday, so it looks like there is some time left for the current correction to unfold.

Looking at the 4h time frame, dollar bulls may not be done yet, unless 105.53 is broken..

Join me in webinar later at 15cet HERE

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.