Hey traders, finally, I am back from Sicily and ready for market action this week.

So, hope you’re prepared for an exciting week ahead, as we’re looking at plenty of volatility with major events on the horizon. The main focus, of course, is the US elections, but we also have the RBA, Bank of England rate decision and the Fed decision, which is expected to include a rate cut. This could make the dollar quite volatile, and we’re already seeing some gaps since Sunday open—though these may fill within 24 hours, as they often do. Or possibly the market may hold sideways until election results start coming in.

Looking at the wave structure and sentiment, the dollar has been trending upward, largely on speculation that Trump could take this election. If that happens, we might see further upside for the dollar, with potential gains in stocks and possibly crypto as well.

The dollar index shows some corrective drop from the highs, its a counter-trend move that might stabilize around 103.40.

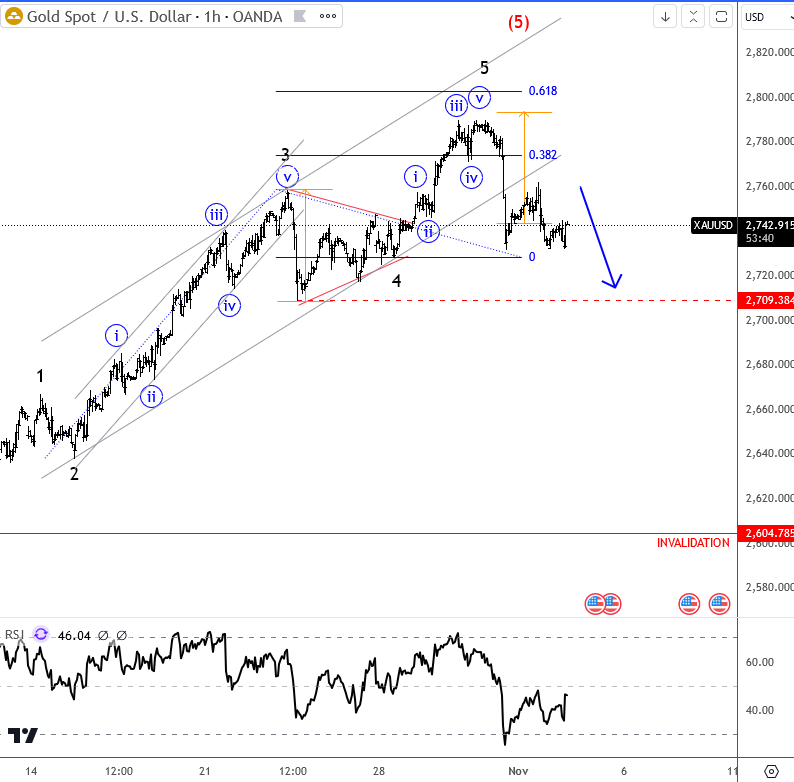

Even strong metals have recently turned south, and looks like gold is headed for deeper correction now, ideally to 2709 in the near term.

I will talk about this and lot more in our webinar later at 15CET

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.