Hey everyone! I hope you had a wonderful weekend. I had a special one, as I just turned 40 and enjoyed some great time with my family!

Now, regarding the markets, it’s interesting to see the US dollar finding support last week, even after the Fed announced a 50 basis point rate cut. The dollar ticked even higher earlier today after some European trading, but these early moves at the start of the week often reverse. I still think we might see another push to the downside when looking at the Dollar Index, and perhaps higher resistance levels will be retested on some of the dollar pairs as well.

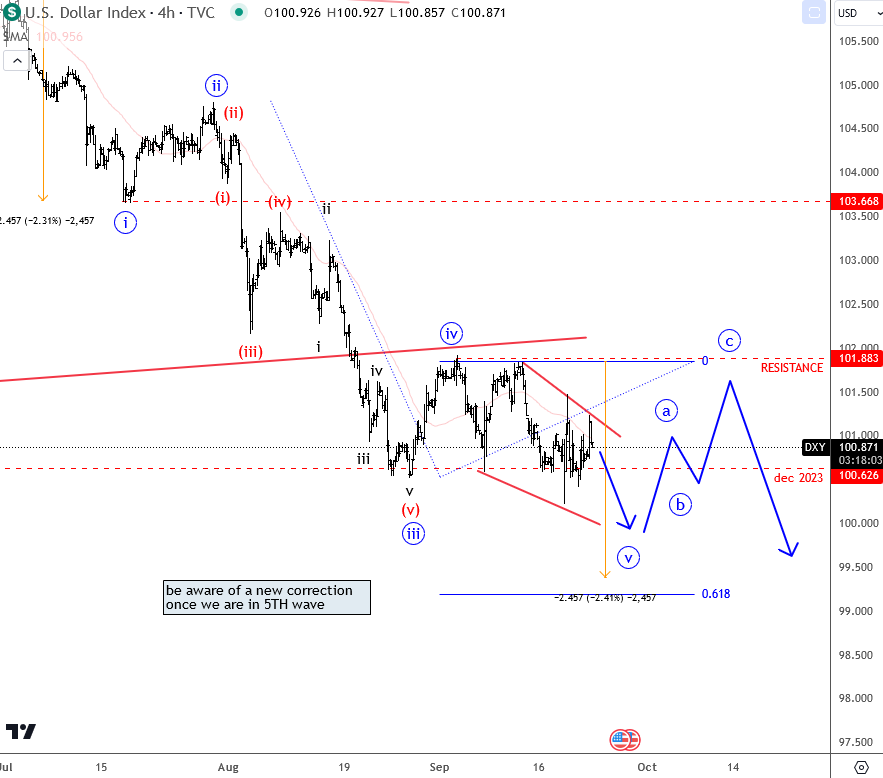

In Elliott Wave terms, I’m looking at an ending diagonal on DXY where we’re likely missing another leg down to complete the structure. But overall, I believe the dollar is running into strong support across the board, and we could eventually see a reversal in the recent trend of dollar weakness. However, I think any higher-degree rally that follows will still be corrective before the market resumes its downward trend. Most of the recent dollar weakness has been driven by expectations of Fed rate cuts, so the “buy the rumor, sell the news” dynamic could still play out. I talked about this in video on Friday and in our webinar below.

Grega

WEBINAR (recording) Sep 23 2024

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.