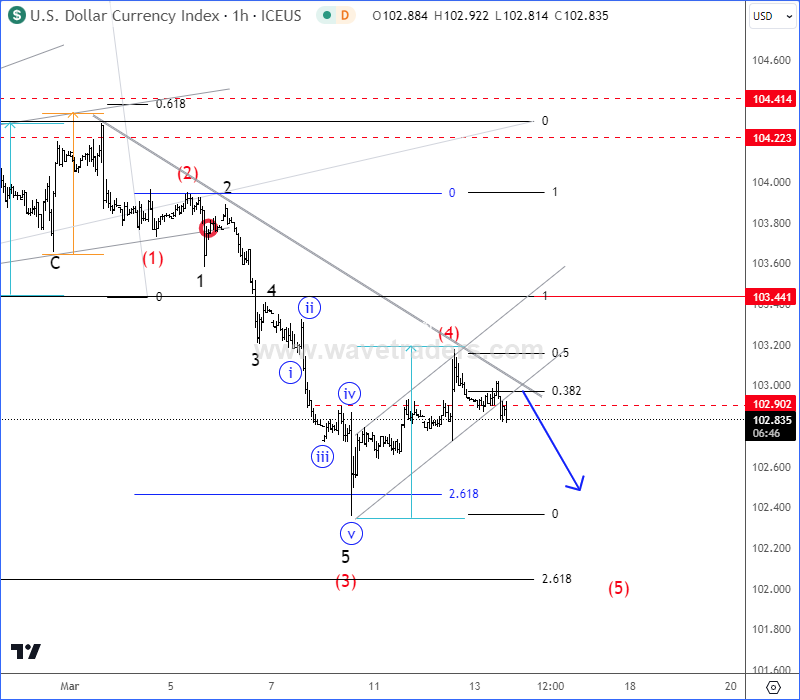

DXY Is Ready To Resume Lower from technical point of view and from Elliott wave perspective.

Hello traders!

USDollar Index – DXY is coming lower again and we have been talking a lot about that in the past articles.

USDollar is actually nicely falling since then due to lower US Yields. There can be actually room for much more weakness, but on the intraday basis, we see room at least for one more leg down towards 102.00 level or lower.

We have seen some intraday recovery recently, but looks like a clear corrective movement in wave (4) from Elliott wave perspective, which can now send the DXY lower for wave (5).

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

FED Rates vs. US Manufacturing PMI. Check our free chart HERE.